NCH Express Accounts Review: Good for Small Businesses?

6 min. read

Updated on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

In this NCH Express Accounts review, I test the app’s key features and how it stacks up against the many other software and web solutions on the market.

Express Accounts offers key finance features like bank reconciliation, accounts payable, accounts receivable, tax prep, and the ability to run multiple businesses under the same account.

But is it good enough for your business? Read on to find out!

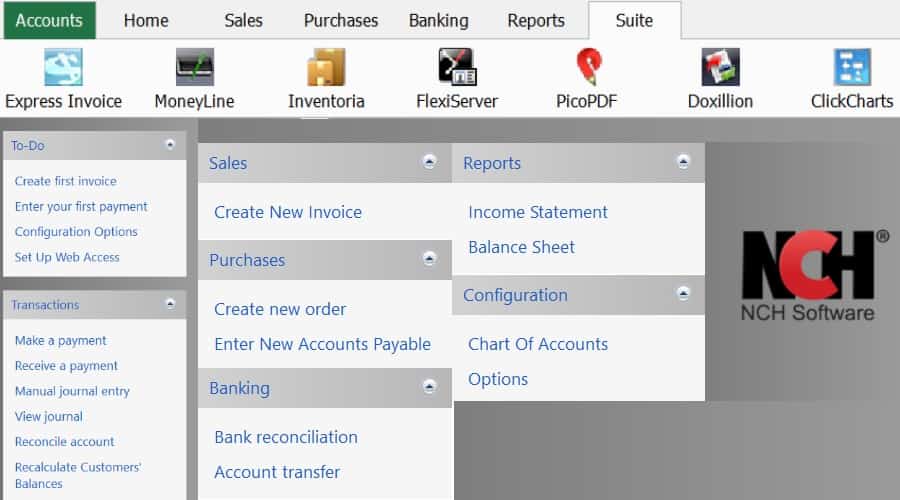

NCH Express – Main Features

After getting hands-on with Express Accounts, these are the main features you can expect, and my thoughts about how well they work.

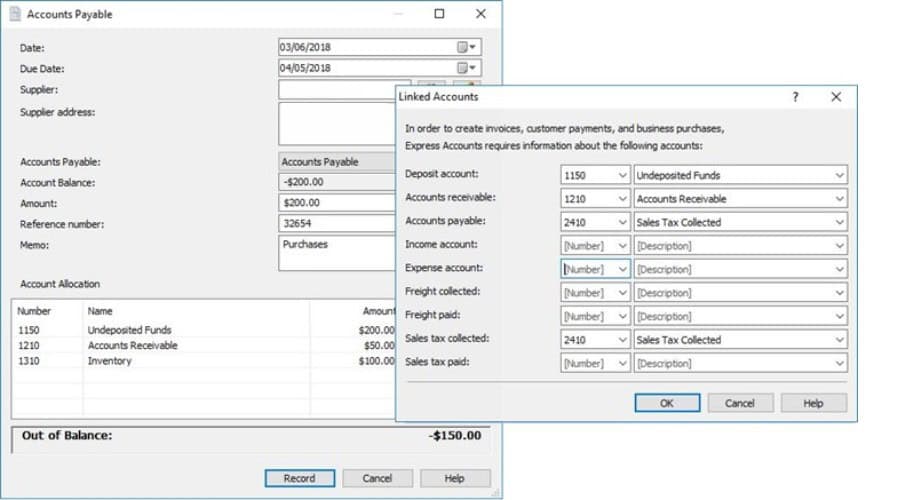

Accounts Payable

This feature manages the recording of invoices received from vendors, tracking outstanding balances, and processing payments. You can also generate purchase orders and create and print checks within the program.

Despite the dated interface, it’s quite simple to add vendor and supplier information, including contact details and payment terms. Invoices keep everything organized with invoice numbers, due dates, and outstanding balances.

Accounts Receivable

Here you manage your sales transactions and track incoming payments from customers or clients. It has a useful invoice creation feature with recurring orders, though this isn’t as advanced as QuickBooks or Xero. It also supports quotes and sales orders.

Overall, it does the job for basic accounts receivable tasks but lacks the level of automation, customization, and reporting capabilities of higher-tier accounting software.

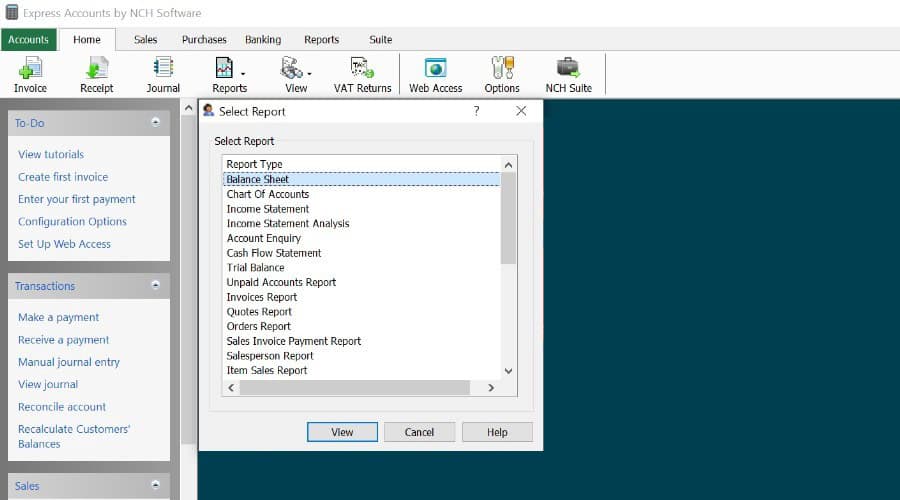

Reporting

One of the tool’s key offerings is the ability to generate 20 essential financial reports, including:

General Ledger – A comprehensive record of all financial transactions.

Balance Sheet – Shows your assets, liabilities, and equity at a specific point in time.

Income Statement – Displays revenue and expenses.

Cash Flow Statement – Tracks the inflow and outflow of cash in the business.

Sales – Sales transactions and revenue.

Orders – Displays purchase transactions and costs incurred.

Accounts Receivable – Highlights outstanding customer invoices.

Accounts Payable – Lists unpaid supplier invoices and the date.

While the range of reports is extensive, what’s disappointing is it sticks to the numbers rather than generating insightful charts and graphs like other more modern software. It also doesn’t do projections, so you can plan better for the future.

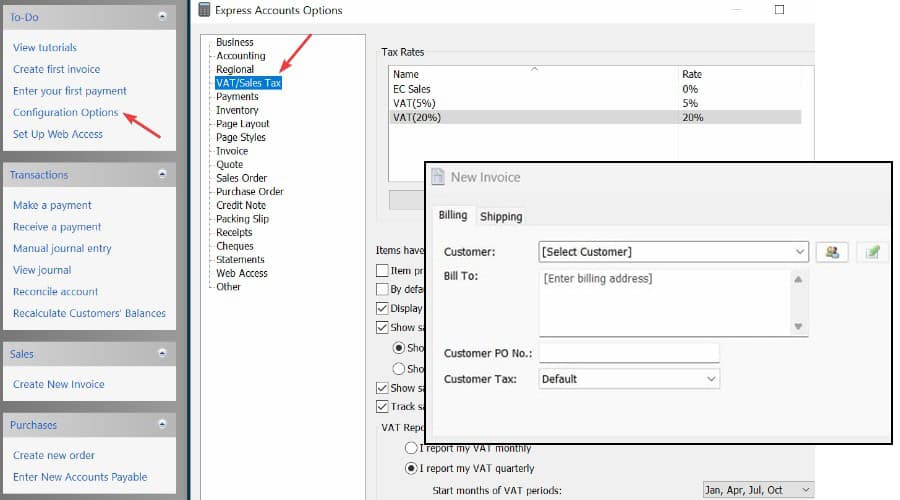

Taxes

Express Accounts also offers reports to help handle your taxes. These provide a detailed breakdown of taxable sales, purchases, and other tax-related transactions within a specified time period.

Moreover, it supports predefined tax rates, tax-exempt items, and the ability to create multiple tax codes for different jurisdictions or types of products and services.

Once defined, the software automatically calculates applicable taxes on invoices and bills, ensuring accurate tax amounts are applied to sales and purchases.

Importing Financial Data

Perhaps the biggest misstep for me is the software’s inability to offer live, real-time connections to bank accounts or other financial institutions. This forces you to manually import transaction data into the software using file formats such as OFX, QFX, QBO, or CSV.

While, in theory, this gives you more control, it’s also tedious and most of today’s accounting software will let you edit any transactions that have been automatically imported anyway.

Reconciliation

It’s good to see account reconciliation, which works well. However, because it isn’t linked directly to your bank or other financial accounts online, you’ll have to manually enter the ending balance and the statement date from your bank statement and then mark what is cleared or unreconciled.

Fortunately, once all transactions have been accounted for, Express Accounts will calculate the difference between your account balance and your bank statement balance for you.

Inventory Management

One area that shows promise is the inventory management feature. This lets you track stock levels, add new items whenever you need, and add inventory items to invoices.

The drawback is you’ll need to use its separate integrated tool, Inventoria, which will increase costs. However, if you’re already using an inventory management tool, this could help streamline the process.

Interface

The Express Accounts interface is dated compared to modern software and web solutions like FreshBooks, QuickBooks, or Xero. It also lacks an accompanying mobile app, so you can’t manage your accounts on the go unless you work off your laptop.

That being said, it’s a lightweight program and the features are clearly outlined at the top and side menus. It also provides a quick link to its tutorial pages if you ever get stuck.

I didn’t find it hard to navigate, but a lack of automation can add time to your workload.

Customer Support

There are mixed opinions regarding NCH’s customer support. There’s no live chat feature, so you’ll have to use the website’s email form to get a direct response.

While writing this NCH Express Accounts review, it took a couple of hours for me to get a response and this could drag on for a while for complex problems. Moreover, those who purchase a license get priority treatment, which isn’t good for free users.

The site does have a lot of supporting tutorials, but if your answer isn’t there, it might get frustrating.

Pricing

NCH Express Accounts is free to use for freelancers or businesses of under 5 users. Alternatively, you can purchase a premium license for unlimited users:

- Basic $129.99 – Standard Edition

- Plus $159.99 – Professional Edition

- Plus Quarterly $26.49 per quarter – Professional Version

NCH Software does offer a 30-day money-back guarantee on all its products, but this isn’t widely promoted and you must contact the company directly to start the refund process.

NCH Express Accounts – Alternatives

There are many other business accounting programs and cloud services you can try instead of Express Accounts.

Some of my favorites include:

QuickBooks – Has the benefit of directly linking to bank accounts, automating reconciliation, and other tasks.

FreshBooks – Another web-based solution with mobile apps, support for payment gateways, and automatic bank reconciliation.

Xero – Modern cloud-based accounting for businesses of all sizes and with mobile apps.

Wave – Great for advanced invoicing features.

Zoho Books – Most suitable for large businesses.

NCH Express Accounts Review – Verdict

NCH Express Accounts has a lot going for it, especially for freelancers and small businesses that can use it for free. All the core accounting features are here.

However, with so many other more advanced and modern accounting solutions on the market, I wouldn’t recommend the paid version for larger businesses.

Its outdated look, tabular reporting, lack of real-time bank integration, and no mobile support, leave it feeling a decade behind everything else.

Because you can try it for free, it still may be worth exploring for yourself if you don’t require an advanced solution.

User forum

0 messages