5 Best AI Sales Tax Tools for Businesses [Tested]

7 min. read

Updated on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Every element of our lives, including the way we handle money and taxes, has been impacted by AI technology. In this area, artificial intelligence has become an efficient instrument that has the potential to make tax-related chores easier for both individuals and corporations.

Now, companies use AI for sales training software, making it easier than ever to get your team ready for any aspect of this field.

The same idea is also applied in other sales-related fields, like automatic email generators and other AI-powered sales tools.

Other than that, sales will never be the same through the employment of AI for sales prospecting, allowing sales reps more time to deal with converting sales. As you can see, almost all aspects of your sales department can be improved using AI, and performing AI sales calls is not excluded.

This article will explore AI tax calculators. We will discuss their capabilities, some of their drawbacks, and the level of necessary human input. This element is crucial, especially for companies that sell goods that need complex tax calculations.

Let’s examine the challenges and opportunities of applying AI to taxation and find the best AI sales tax calculators.

Can I use AI to do my taxes?

Yes, you can use AI to calculate, evaluate, and pay your taxes with ease. This is an excellent help for individuals but becomes even more critical if you have a business that pays taxes for each of the sales you produce, making the process highly overwhelming.

AI tax software has been developed to streamline and automate the complex tax calculation process. These complex technologies use machine learning algorithms and data analysis to simplify your task:

- Accurate tax calculations – calculates taxes with great precision (income tax, sales tax, etc.)

- Time-efficiency – A job that would typically take humans hours to complete is done in a few minutes

- Real-time updates – As the tax and regulations are constantly changing, AI tax software can adapt instantly

- Data analysis – Can help by identifying potential deductions, credits, and exemptions

While AI tax calculators have numerous benefits, it’s crucial for us also to understand their limitations:

- Lack of context – An AI uses patterns and data to make decisions, but it can’t consider the unique context of your financial situation. Human input is essential to provide context and make nuanced decisions

- Complex scenarios – AI may have difficulty providing reliable results when tax calculations include complicated legal considerations or unexpected methods. In situations like this, human skill is essential.

- Data interpretation – Data analysis by AI may not be completely accurate. Humans are better suited to comprehend the complexities and nuances of financial data.

What are the AI tools for calculating taxes?

After carefully testing numerous providers, here’s a hand-picked list of the best AI tools to calculate your taxes:

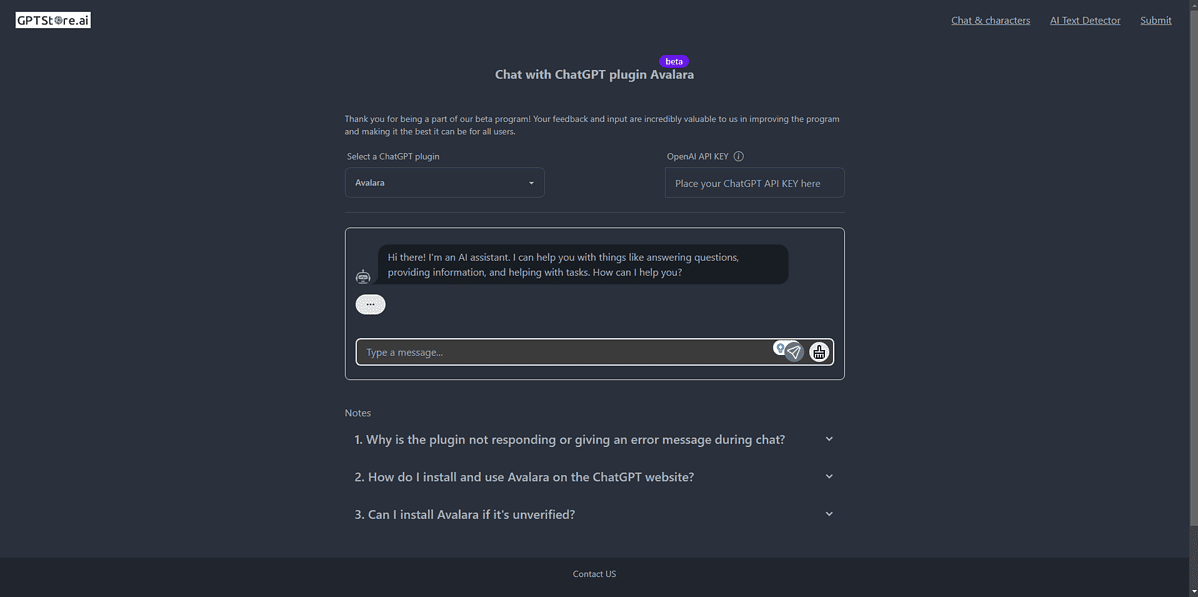

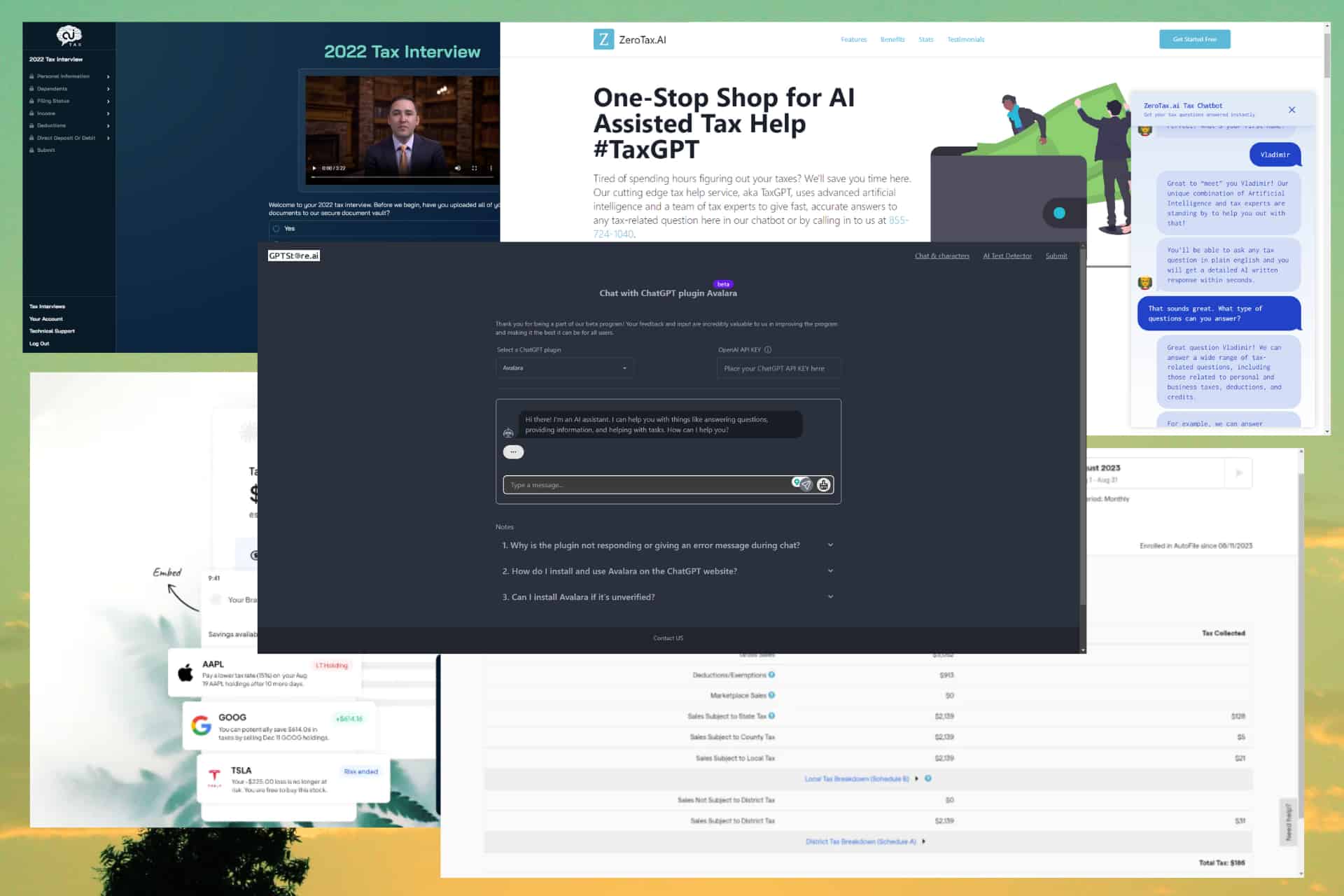

1. Avalara ChatGPT Plugin – Best Overall AI Sales Tax Calculator

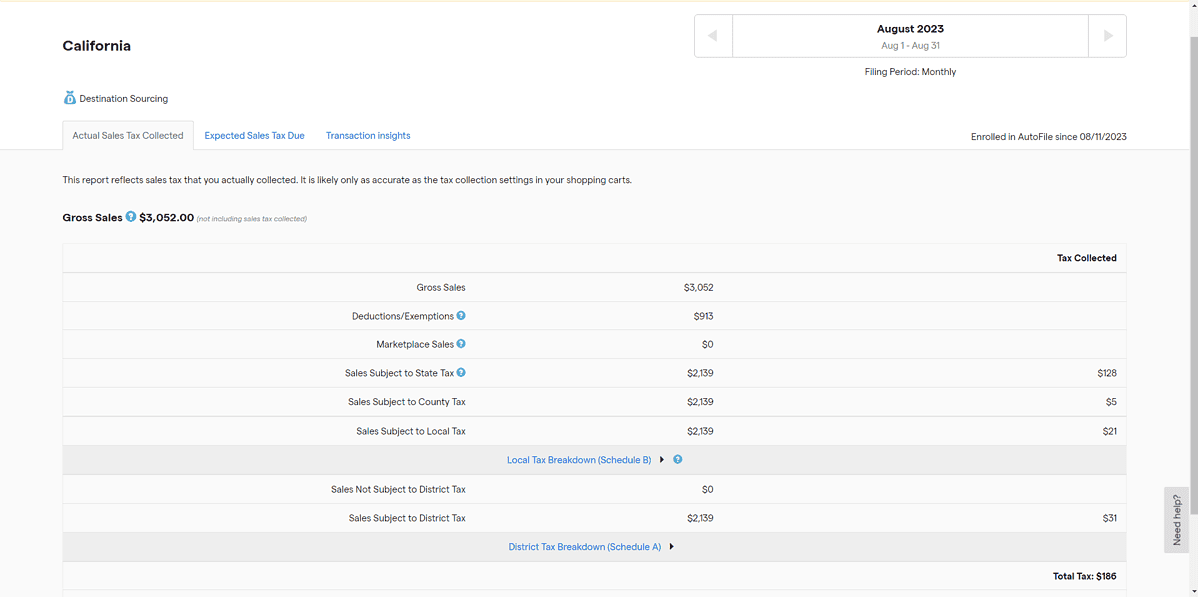

Avalara is a well-known AI tax solution focusing on sales tax automation. It ensures compliance across several jurisdictions, and it aids businesses in determining the correct sales tax rates and transaction regulations.

Avalara has also released a sales tax calculator plugin for ChatGPT, making it a revolutionary sales tax app and the first to include this option.

Businesses and consumers with ChatGPT Plus accounts can easily install the Avalara plugin from ChatGPT’s plugin store and thus increase overall efficiency and productivity regarding efficient tax filing.

Pros

- Precise sales tax calculations across various jurisdictions

- It integrates seamlessly with many e-commerce platforms

Cons

- Prices may be too high for small businesses

2. TaxJar’s Emmet – Efficient E-commerce Tax Automation

TaxJar was already well-known on the market for offering helpful software that deals with taxes, but now the game has changed entirely with the introduction of its in-house AI called Emmet.

As the company already offered an intuitive interface allowing users to access its tax automation capabilities, the new introduction of AI makes it even simpler and more efficient.

It is the perfect solution for online shops because it works efficiently with well-known e-commerce systems. Emmet makes sales tax calculations simple, guaranteeing that companies can easily comply with regulations. Businesses that deal with large transaction volumes can significantly benefit from its efficiency and accuracy.

Pros

- Intuitive and user-friendly interface

- Efficient sales tax automation processes

Cons

- Primarily focuses on sales tax automation, which might not cover all tax needs for some businesses

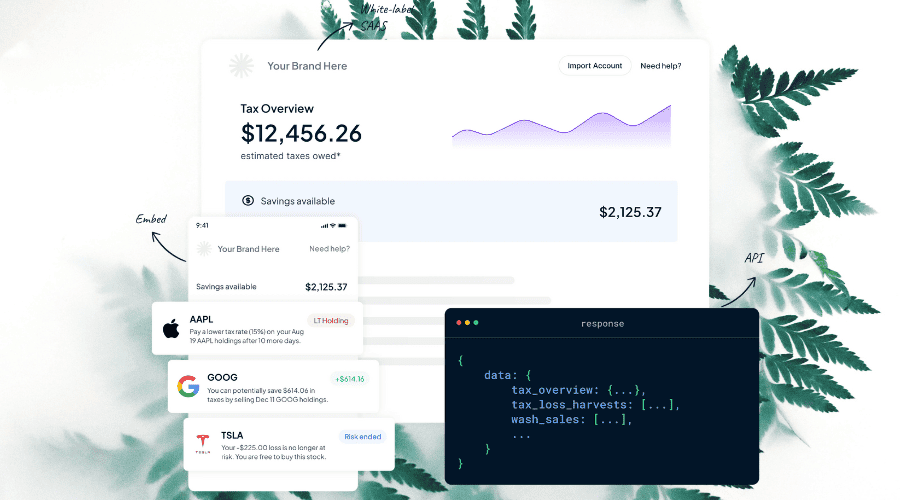

3. Reconcile – Comprehensive Financial Insights

Even though it is just in Beta version, Reconcile allows you to bring AI to the forefront and ensure that the robust algorithm crunches your numbers, examines your financial data, and creates accurate tax estimations adapted to your situation.

This software takes a few minutes to analyze all the details of your finances, identifying any deductions, credits, etc. One of the most exciting features of this software is the real-time AI-tax support function, allowing you to ask for help 24/7 whether you want some guidance or need to understand complex tax concepts better.

As we know, the human touch is also essential when it comes to taxes. This is why Reconcile has a professional human tax consultant evaluate your inquiries carefully and offer possible courses of action.

Pros

- In-depth financial insights and tax planning

- Perfect for businesses seeking a complete financial solution

Cons

- The level of complexity might be too much for smaller businesses with more straightforward task needs

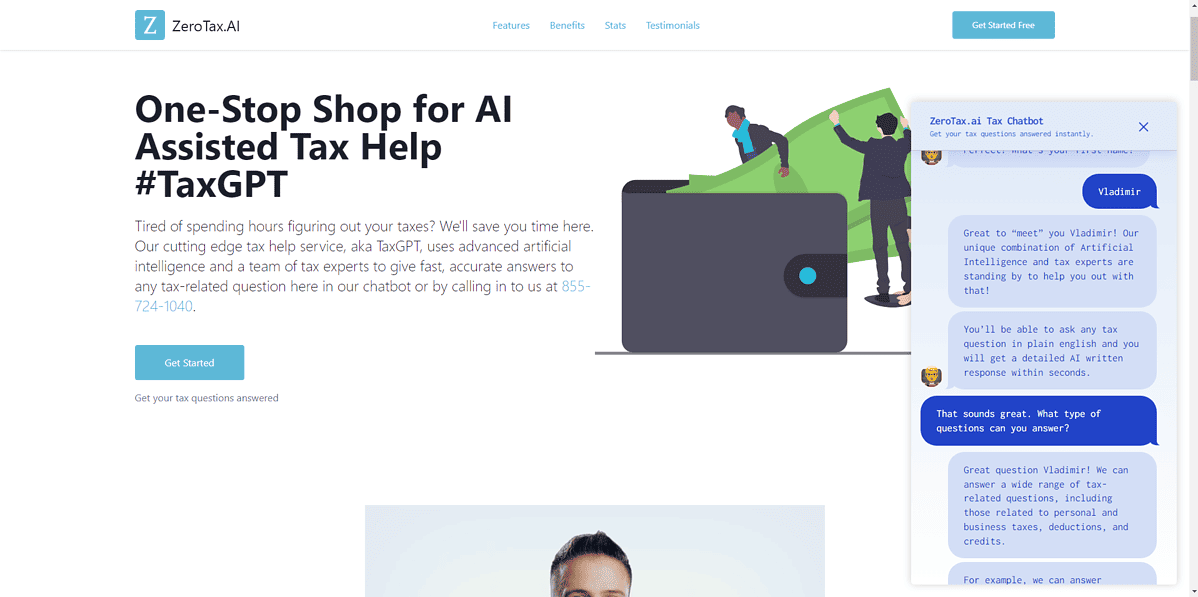

4. ZeroTax AI – Streamlined Small Business Tax Compliance

ZeroTax AI uses the so-called TaxGPT AI assistant to answer questions and guide you towards your tax-related goals. The interface is straightforward and built into the main website like a normal chat.

The TaxGPT assistant is entirely free to use and starts a conversation by saying hello and then asking you what you want to do, allowing you to choose some pre-determined answers that can be activated with a click.

Before answering your question, the ZeroTax.ai chatbot gives you a disclaimer saying that its answers are for informational purposes only and that the service is not a substitute for consulting with a tax professional.

Thankfully, the platform also offers human-to-human tax consultancy, allowing you to pay a sum and get an answer, which a human professional in the field checks. It is worth noting that the solution will be available within 24 hours, so it is not as instant as the AI chat. Nonetheless, it provides more accurate information.

Pros

- Perfectly designed for small businesses’ tax calculations

- Automates the process of tax calculations and helps companies minimize tax liabilities

Cons

- Although suitable for smaller businesses, it might not have the proper scalability for bigger enterprises

5. AiTax – Precision Income Tax Calculator

AiTax specializes in calculating income taxes and guarantees accuracy while maximizing deductions for individuals and businesses. It’s a valuable tool for determining tax liabilities and improving financial plans. Users of AiTax are equipped to efficiently manage the complexities of income tax law and make wise financial decisions.

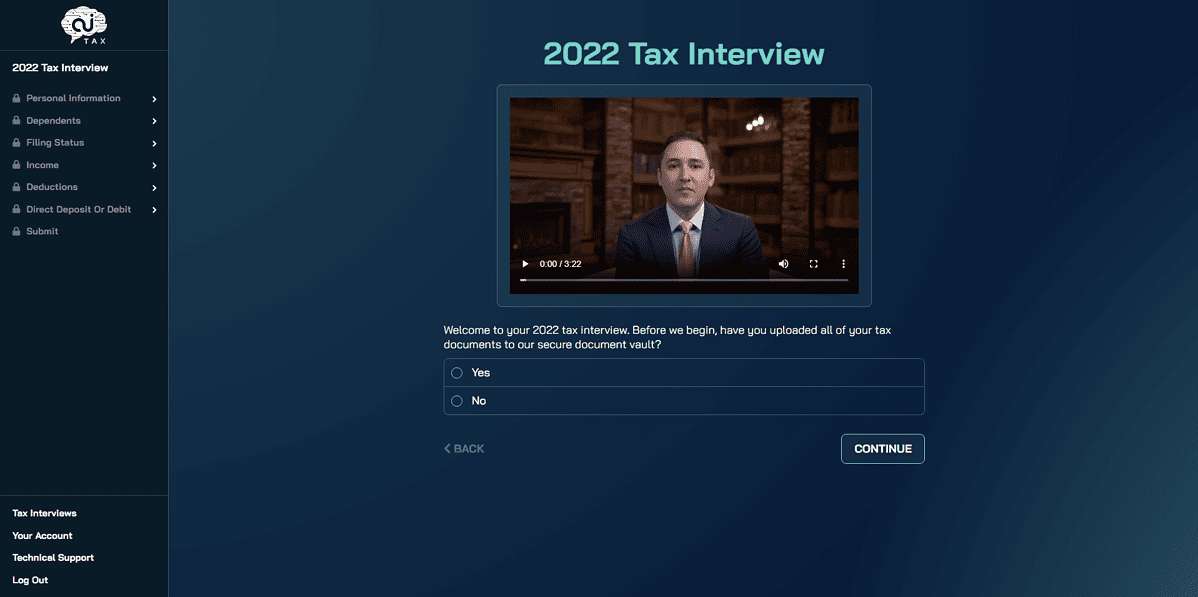

This software takes you through filing and understanding all aspects of your tax requirements, making this process available and accessible to anybody with an internet connection. The app asks you specific questions, and the AI algorithms store and analyze the answers to give you the best suggestions and help you need.

Pros

- Specialized in income tax calculations with fantastic accuracy

- It helps users better understand their tax situation and other tax complexities

Cons

- As it only covers income tax, it might not be a suitable option for more prominent companies with more complex needs

Using AI to calculate taxes can be a game-changer for individual users and companies alike. This method of dealing with your taxes ensures accuracy, efficiency, and compliance with all the laws in your state.

These AI tax calculators provide many advantages, including accurate calculations and real-time updates. But, especially in complex settings, it’s critical to understand their limitations and the value of human input.

AI tax software will become an essential financial management component as technology develops. People and organizations should consider their unique requirements, pick the best AI tax software, and supplement it with human expertise when needed to utilize these technologies’ powers.