Paypal, Venmo announce increase to instant transfer fees in the US

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Paypal and Venmo announced on Thursday the changes that will be rolled out regarding the instant transfer fees for US customers. These changes will apply on May 23, 2022 for Venmo customers and June 17, 2022 for PayPal customers. These changes were introduced to be more in line with the value that they are rendering, PayPal said.

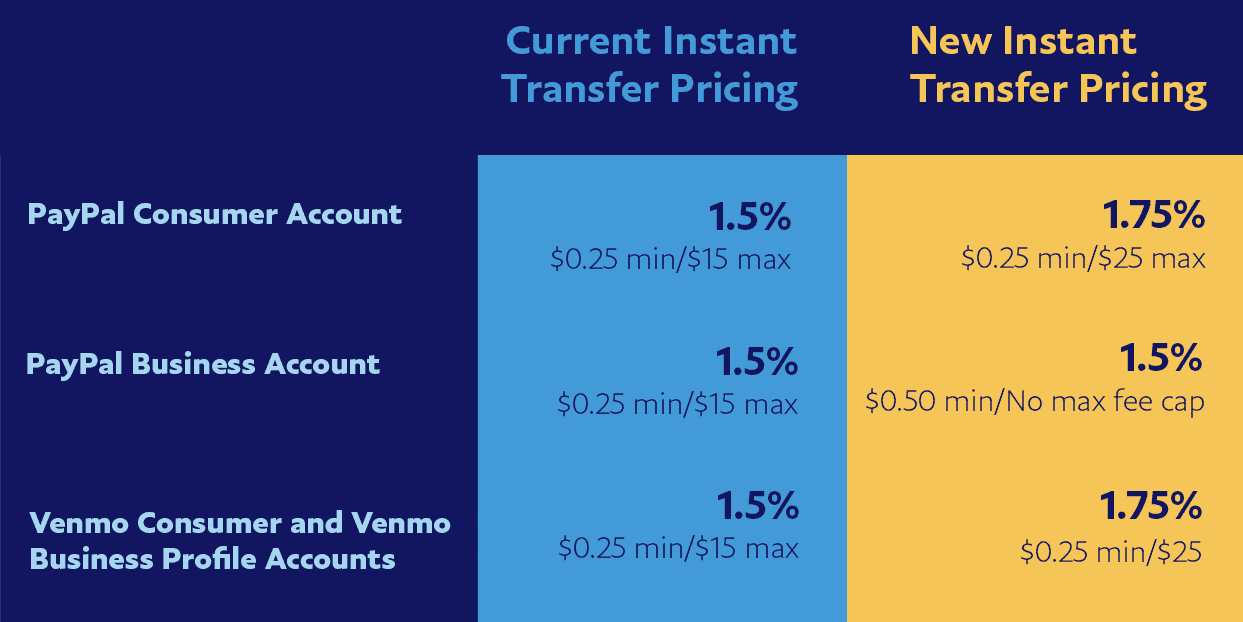

With this feature, customers could easily transfer their money to bank accounts or debit cards for certain fees. Currently, PayPal Consumer Account users pay 1.5% of the transfer amount with a minimum fee of $ 0.25 and a maximum of $15. The same rate applies to Venmo Consumer and Venmo Business Profile account users. With the new instant transfer pricing, these accounts’ transfer fees will be increased to 1.75% of the transfer amount. Further, the existing cap will be raised from $15 to $25.

Meanwhile, Paypal retains the instant transfer fee for business account users to 15% of the transfer amount. However, the minimum transfer fee was increased from $0.25 to $0.50. Further, the existing $15 cap for the transfer fees was removed. Therefore, there will no longer be a maximum fee-cap structure for the PayPal Business accounts.

The standard bank transfer in PayPal and Venmo remains free. However, the transaction takes around 1 to 3 business days from the moment you made the request for transfer. This is a bit inconvenient in the era where most transactions where customers use these transfers require quick processing. In such cases, customers would simply have to embrace the higher rates that fees will scrap away from their transfer amount.

For almost two decades, PayPal focused on the peer-to-peer payments business. However, as competition emerged which best offer involved the ability to instantly cash out to a customer’s bank account, Paypal eventually rolled out its own instant transfer feature in 2017.

User forum

0 messages