NCH MoneyLine Review: Outdated but Passable Finance Software

6 min. read

Updated on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

In this NCH MoneyLine review, you’ll learn about the tool’s top features and whether it’s the right solution for you in 2024.

Personal finance software is crucial for tracking income, expenses, and budgets in an organized manner.

Here’s where NCH MoneyLine comes in. This Windows program is aimed at individuals and small businesses who need to track their money, monitor bank accounts, and manage their spending.

I tested it and here’s what it can do.

Features

This is a basic finance suite with some useful core features. User-written NCH MoneyLine reviews don’t seem to be too impressed with the tool, so I decided to test it for myself.

Here’s what stood out to me the most and how it compares with similar tools:

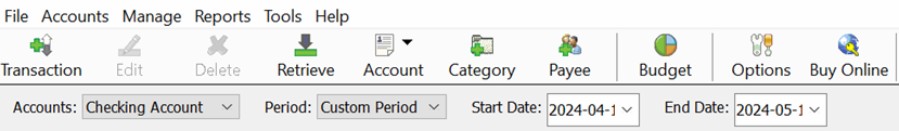

Checkbook Register

The main checkbook register allowed me to add and track multiple accounts, ensuring that all financial information is organized and accessible in one convenient location. Summaries are shown down the left pane and you can use a dropdown menu to select a specific account for closer inspection.

It supports a full range of account types, including checking accounts, credit cards, and even investments.

However, it lacks a General Ledger and Balance Sheet that you might need for more advanced accounting.

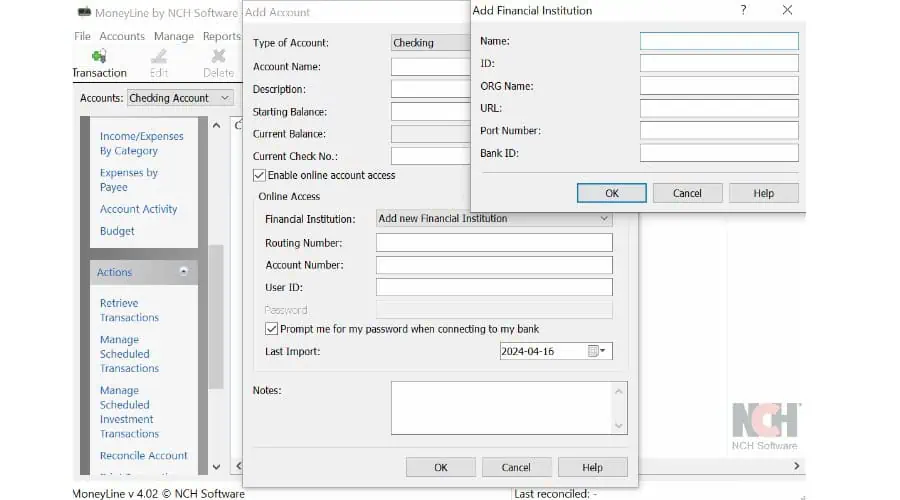

Real-Time Account Integration

I found its most useful feature to be the real-time account integration. For example, instead of manually exporting transactions from a bank account, you can link it to the software directly over the internet, so it runs on autopilot.

The process was as simple as clicking the Add Account button, entering the details, and checking the Enable online access box.

I still felt a little uneasy about supplying account passwords, which is an outdated method and could potentially pose security risks. Moreover, reconciliation doesn’t always go smoothly.

Reconciliation

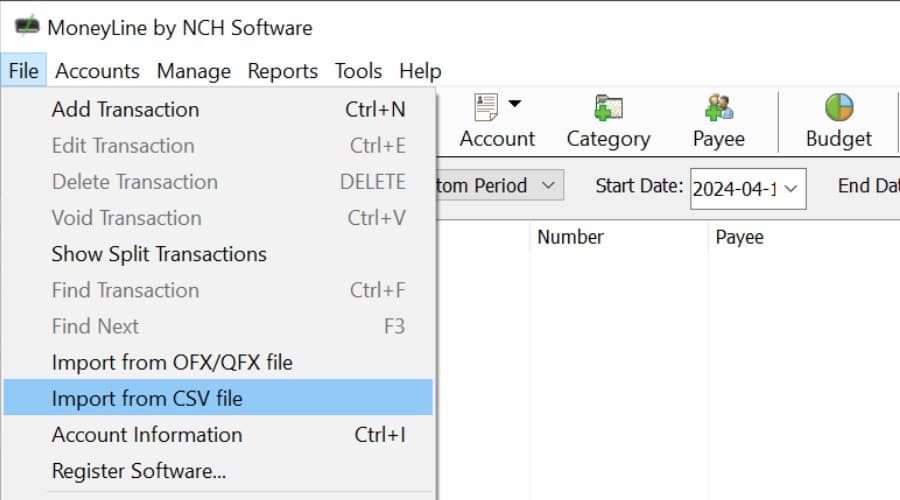

By using reconciliation, you can make sure recorded transactions align with your bank statements. But there’s a manual aspect to this which can be time-consuming, whereas other tools like Xero offer an auto-reconcile feature.

With MoneyLine I had to import my bank statement in CSV, then manually compare and mark each transaction as cleared or uncleared. When transactions have fallen through the net, you must add them manually before the software will calculate the differences.

Even worse, if you make one single error, you must repeat the entire process instead of editing the problem transaction.

Investments

You can add investment accounts in the same manner as any other account, selecting the appropriate type e.g., brokerage, IRA, 401(k), from the list of supported financial institutions.

Once connected, MoneyLine again automatically downloads and categorizes investment transactions, allowing you to monitor the value and performance of your investments.

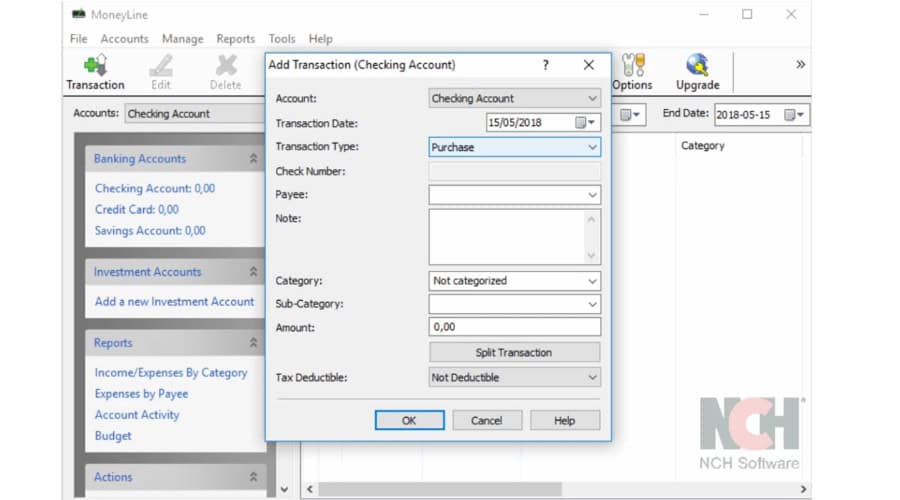

Split Transactions

Another useful feature is the ability to split single transactions into different categories.

For example, if you went to the store and purchased both food, clothes, and business items, splitting the transaction into categories lets you track spending more accurately and isolate business expenses from personal spending.

Reports

Understandably visualizing your finances is important, but MoneyLine is yet to provide reports that include graphs and charts to properly analyze your finances.

However, it does offer traditional financial reports based on tables and figures. These include:

- Income and Expenses – Summary of income and expenses over a specified period.

- Budgets – Compare actual spending against your planned budget.

- Accounts – Detailed information about specific accounts, including transaction history, balances, and reconciled transactions.

- Categories – Spending by category, making it easy to identify areas where you may be overspending or underspending.

Scheduling Transactions

By scheduling transactions in advance, you can ensure that you never miss a payment and can accurately forecast future expenses.

MoneyLine automatically categorizes scheduled transactions like mortgage payments or paychecks, making it easy to track spending and budget accordingly.

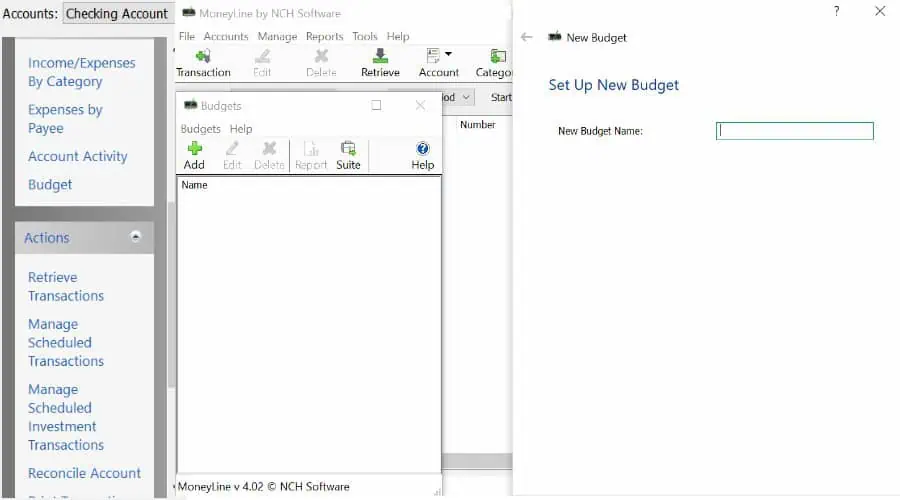

Budget Wizard

If like me, you find creating a budget difficult, MoneyLine walks you through the process with a series of questions about your income, expenses, and financial goals.

The tool will automatically generate a budget plan that includes categories for common expenses, such as housing, transportation, and food. I particularly like that you can then fully customize your budget by adding, removing, or adjusting categories to fit your lifestyle as and when it changes.

Once a budget is set up, the software tracks spending and provides alerts when you are approaching or exceeding your limit.

Interface

The user interface is relatively easy to use, allowing you to navigate clear tabs and manage your finances without much of a learning curve. However, it looks very dated when compared to the likes of Quicken, QuickBooks, and Xero.

These platforms also provide an accompanying set of mobile apps, which is lacking from MoneyLine. If you want to sync up and check your accounts on the go, you should look elsewhere.

Customer Support

Customer support is hit or miss. The site does offer tutorials, but contacting an actual support agent is hindered by an online email form with no live chat or number to call.

While I did get a response for a basic question the same day, other NCH MoneyLine reviews from users report long response times or even no response at all.

Pricing

NCH MoneyLine is priced on an unlimited-use one-off license or an optional quarterly plan for business users. You can try the unlimited version for 14 days before purchasing a license.

- Professional $139 – for business use

- Home license $99 – for individuals

- Professional Quarterly $23.16 – billed quarterly

- Free Non-Commercial – for personal use with standard transaction tracking and budgeting.

Be sure to check for current discounts and deals.

NCH MoneyLine Alternatives

If you’re looking for a better alternative with a modern interface, visual reports, and more advanced features, the following are worth checking out:

- Quicken – Modern web dashboard and mobile apps.

- QuickBooks – Modern web dashboard and mobile apps with accounting features.

- BankTree – Lots of extra features including receipt scanning.

- Xero – Best for businesses that need accounting features.

- NerdWallet – FREE money-management web and mobile app.

NCH MoneyLine Review – Verdict

NCH MoneyLine is an ok product for basic personal finances, but it lacks some advanced accounting features and doesn’t compare to the modern alternatives listed above, especially for business users.

Its dated interface and clumsy reconciliation feature need improvement to rank among the top solutions on the market. In the era of web-based platforms, mobile apps, and visual reporting, it falls short.

Other NCH MoneyLine reviews from users agree there’s a lot of room for improvement.

Nonetheless, you can try it for free and use its core features for non-commercial purposes, so it still may be worth testing yourself before making a final decision.

User forum

0 messages