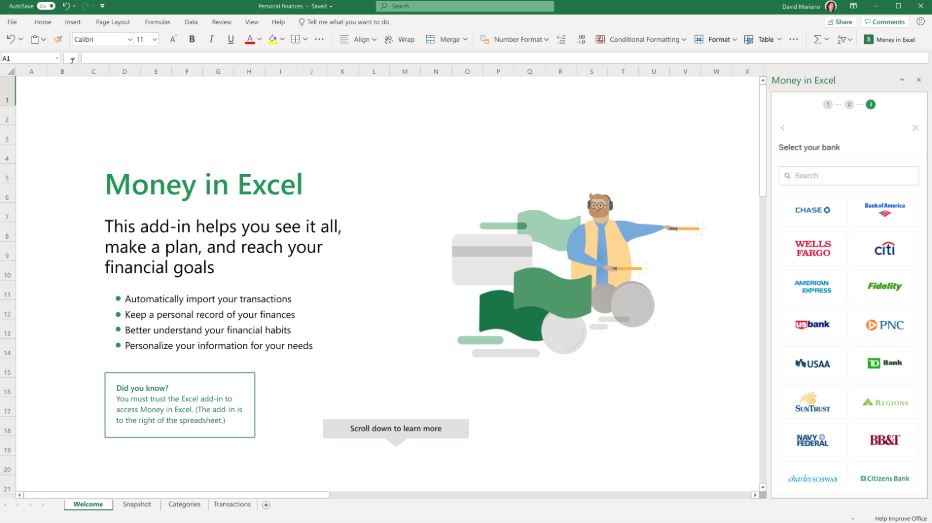

This new fintech startup is behind Microsoft’s Money in Excel feature

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Microsoft yesterday announced a number of new features for Office 365 subscribers — one of them being Money in Excel feature.

Money in Excel is a new add-in that makes it easier for you to manage, track, and analyze your money and spending. All you must do is connect your bank accounts and credit card accounts to Excel by following a few simple steps and Excel will take care of the rest.

Supporting number of financial institutions across the world for this feature is a complex process. Instead of building the integrations on its own, Microsoft is relying on a fintech startup called Plaid. Plaid enables Excel users to securely connect their financial accounts, import the data within them, sync balances and transactions over time.

Here’s how Money in Excel works:

- Plaid provides the permissioned connection to financial accounts via Plaid Link from directly within the Microsoft Money in Excel experience.

- After linking their account(s), the individual will have access to their balance and transaction history, providing an up-to-date and holistic financial picture.

- Plaid connects to 11,000 institutions across the US, Canada, and Europe. In the US, Plaid supports nearly every institution from the major retail banks to community credit unions.

“Monthly Snapshot” sheet will allow users to have personalized charts and graphs based on their financial data to help them better understand your spending behaviors. Users can also add templates that are relevant to them for more customization.

Money in Excel will start to become available in the U.S. in the coming months.

Source: Plaid

User forum

0 messages