Best Checkbook Software for Windows [10 Powerful Apps]

9 min. read

Updated on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Looking for the best checkbook software for Windows? I’ve got you!

With the rise of digital banking and online transactions, it’s important to have a reliable tool to manage your finances.

That’s why, I tested the leading apps in the field and boiled it down to the top 10.

Read on to learn more about their features and to find the most suitable software for you:

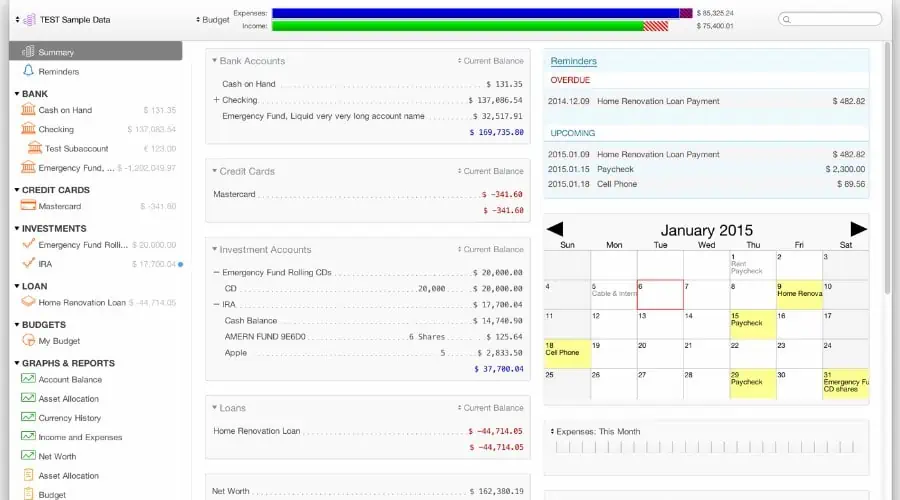

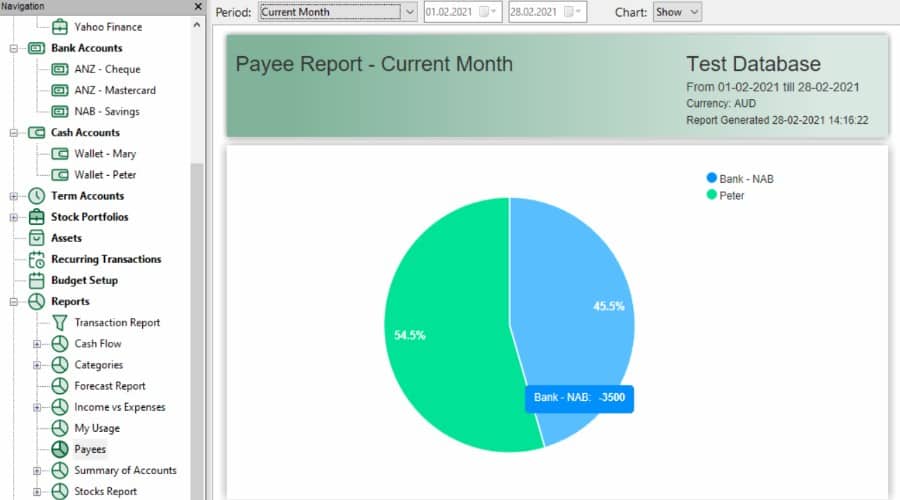

1. Moneydance

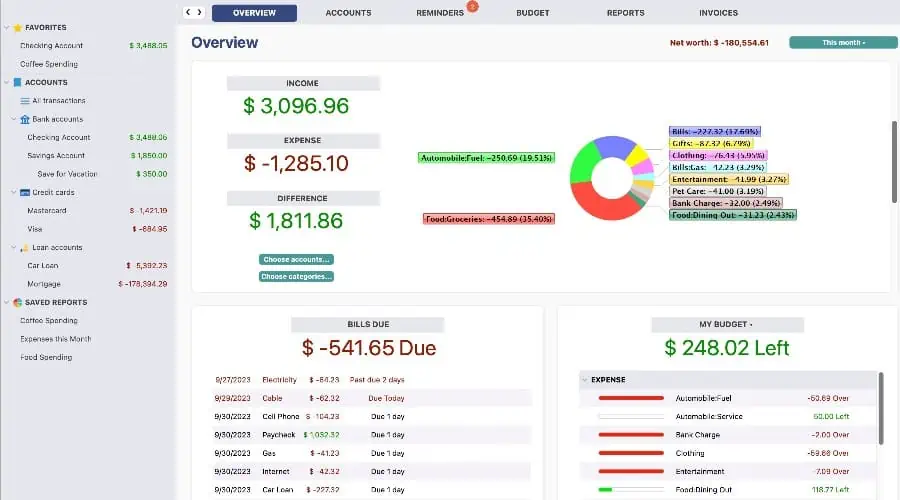

Moneydance is a powerful personal finance management software that allows you to manage your finances, including your checkbook, budget, and investments. It can integrate with your bank and credit accounts to download transaction data and even make payments via direct connection.

Its user-friendly dashboard shows a summary of balances, pending and overdue transactions, and upcoming payments, with a helpful calendar widget.

Moneydance also offers a range of report and analysis tools to help you understand your financial situation and make informed decisions. Everything you do is protected by end-to-end encryption and optional password protection.

Try it for free or purchase a lifetime license for $65. A $9/mo subscription is also available.

Pros:

- Modern and user-friendly interface

- Directly connects to accounts without exporting and importing

- Get reminders and use an accompanying mobile app

Cons:

- The $65 license includes only one free software update

- Clunky spending categories

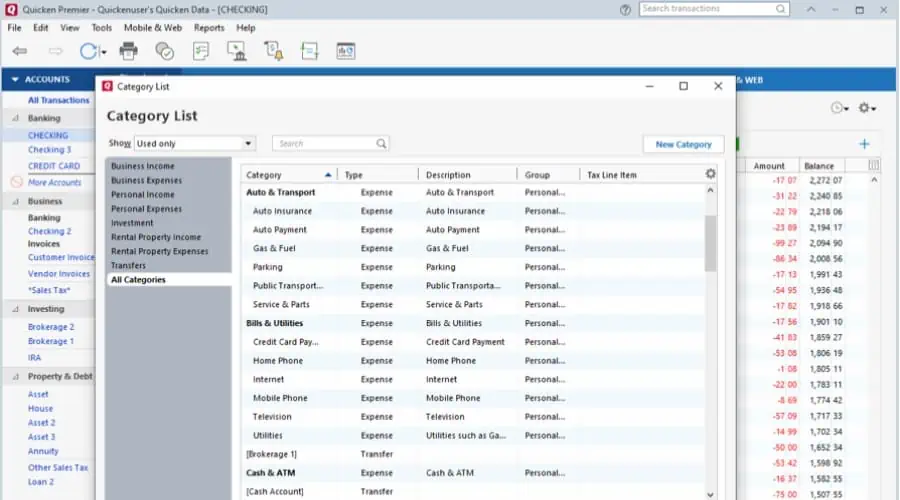

2. Quicken

Quicken is a popular and long-running personal finance software for Windows and other platforms. It covers checkbook features, budgeting, billing and payments, banking integration, and even tax preparation. Its comprehensive reporting gives you insights into income and expenses, investment portfolios, tax, and net worth.

Quicken uses strong AES 256-bit encryption for all data that’s transmitted and you can password-protect your data file.

The interface is fairly straightforward, with a menu-based system with easy access to features and reports. However, some users find it a bit clunky and outdated.

Its main drawback is pricing, ranging from $34.99/year for the Starter edition to $99.99/year for the Home & Business edition. Those on a budget should consider GnuCash, Microsoft Money Plus Sunset Deluxe, and other free options.

Pros:

- Includes tax and investment features

- Real-time account integration

- Detailed reporting

Cons:

- Outdated interface

- Expensive if all you need is basic checkbook software

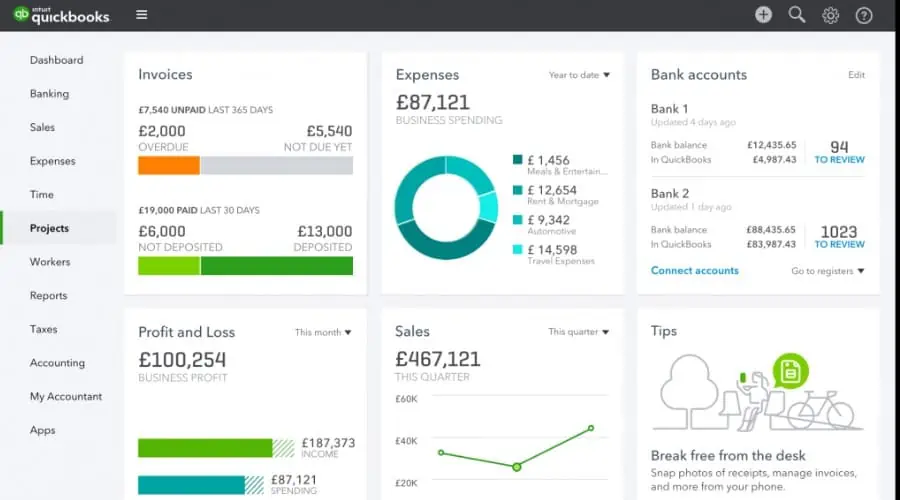

3. QuickBooks

The QuickBooks Desktop version is comprehensive accounting software but is worth it for your checkbook needs if you ever require additional features or are running a business.

It handles all bookkeeping, invoicing, and expense tracking, as well as inventory management and payroll for businesses.

You can manually enter transactions into QuickBooks or import them electronically from your bank accounts with encryption. It also offers features for printing traditional checks, reconciling bank accounts, and generating reports related to checkbook transactions.

Reports can be customized, but also generally include profit and loss, balance sheet, cash flow, sales reports, expense reports, and more.

Pricing ranges from $15 to $60 per month, depending on your needs.

Pros:

- Comprehensive finance software suitable for businesses

- Affordable pricing for basic checkbook features

- Real-time accounts integration and auto payments

Cons:

- Can be overwhelming for beginners

- Known to have slow customer support

4. Moneyspire

The modern Windows interface for Moneyspire is designed to easily help you track your income and expenses, set up a budget, and reconcile your accounts. For businesses and freelancers, it also offers invoicing.

It can handle transactions in multiple currencies, and you can set up recurring transactions, such as bills and paychecks. Its reminders mean you’ll never miss a payment again. Moreover, Moneyspire Connect allows you to securely sync with your banks and automatically download your transactions.

The software generates various reports to help you understand your spending and income and they are fully customizable and interactive.

It costs $69.95 for a one-time payment for personal use.

Pros:

- Try for free for 30 days and 25 transactions

- Real-time accounts integration

- Invoicing system

Cons:

- Includes banking fees

- Initial setup up can take a long time

5. Sage Intacct

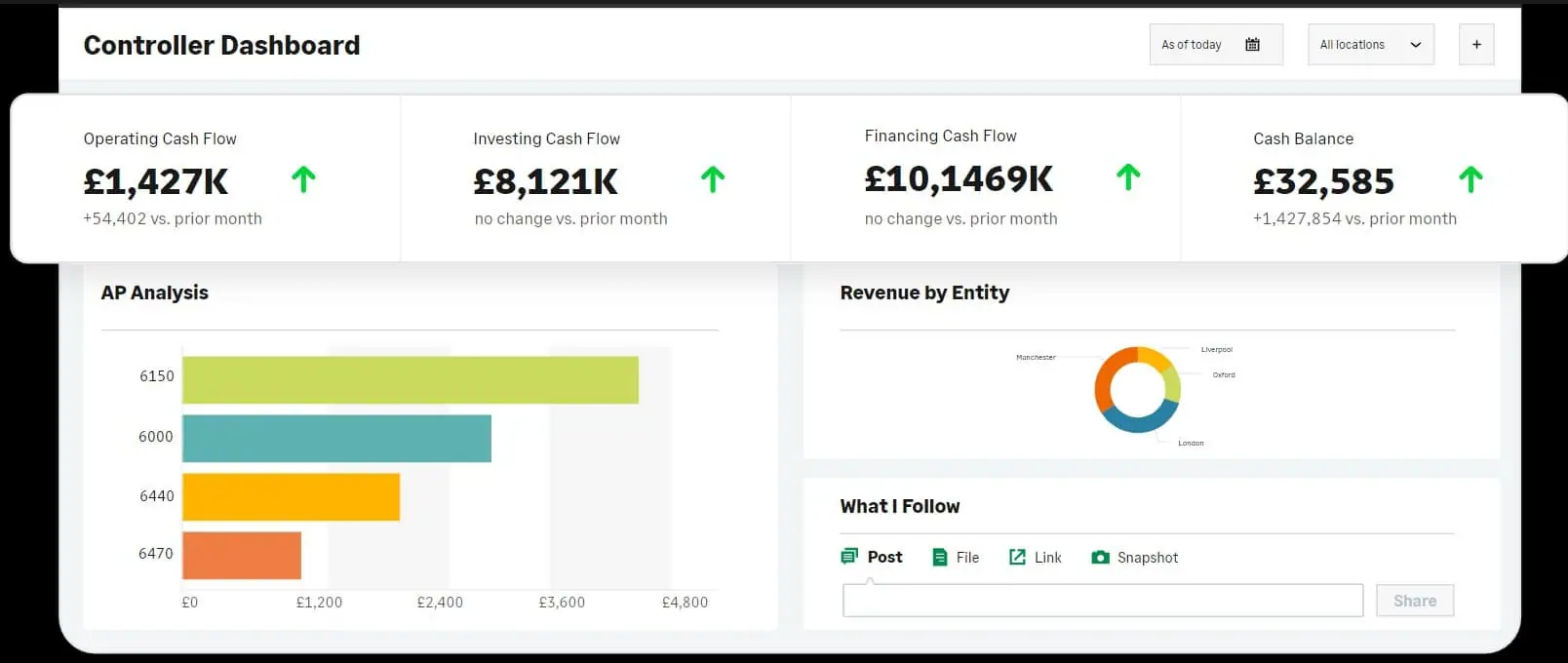

Sage Intacct is a complete financial support solution that will greatly simplify anything related to finances and accounting.

After connecting your accounts in this app you will have access to all your transactions and balances. You will be able to visualize cleared or pending checks and even use graphs to get a better overview of where your money is going.

Being such a powerful software, Sage Intacct allows you to easily engage with other financial aspects, such as accounts payable, inventory management, invoicing and many more. You will not need to operate different tools for each process.

Pros:

- Integration with other apps

- Amazing reporting and exporting features

- Very effective financial budgeting and planning

Cons:

- Navigation has a learning curve

- At times the platform can be quite slow

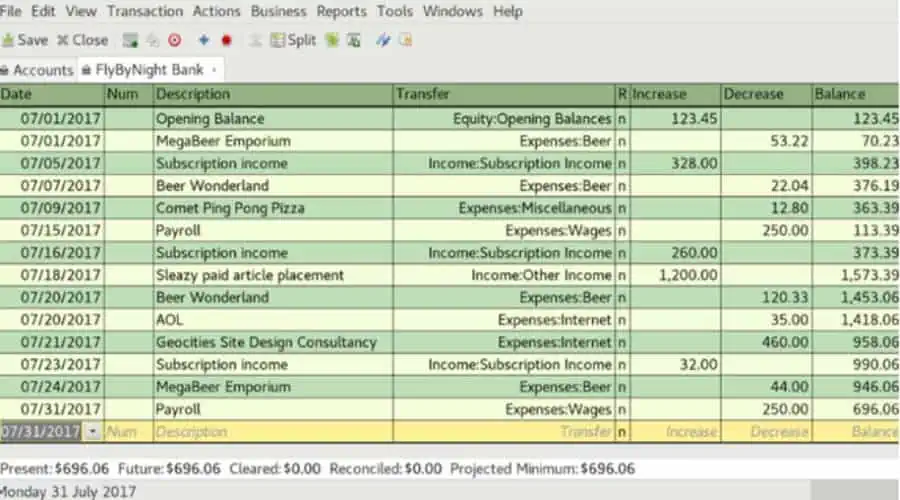

6. GnuCash

GnuCash is a free, open-source accounting software that helps you manage your checkbook and other financial transactions. It’s especially good for business owners but has all the features for personal finance too.

Key features include double-entry accounting, invoicing and bill payment, and reporting for balance sheets, profit/loss, and more. It can integrate with your bank accounts through the AqBanking module.

GnuCash also includes tools to help you create and manage budgets, allowing you to set spending limits and track your expenses against your budget. Remember to set a password to protect your financial data.

Pros:

- Free and open-source

- Simple user interface for beginners

- Real-time account integration

Cons:

- Doesn’t integrate easily with other tools

- Cannot make payments through the software

- Lacks end-to-end encryption

7. Microsoft Money Plus Sunset Deluxe

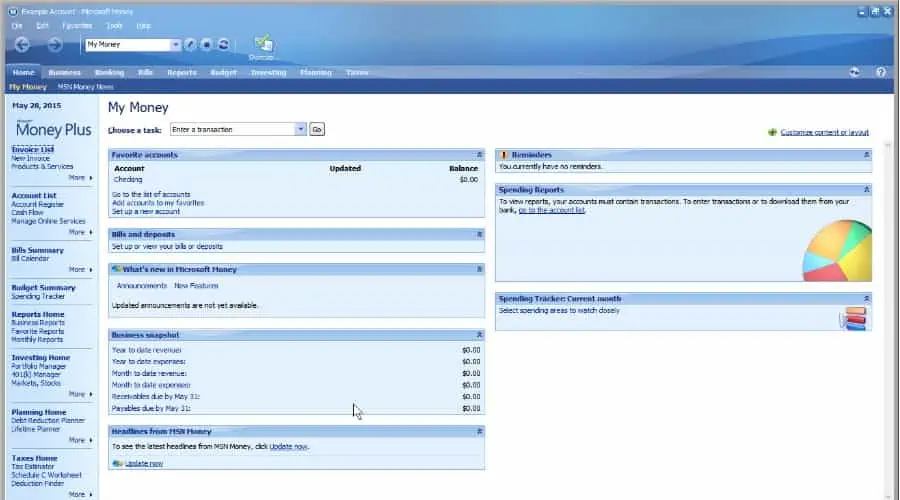

Microsoft’s free, standalone Money Plus Sunset Deluxe software offers basic features for managing your checkbook finances. I.e., tracking your expenses, budgeting, and creating reports. It also lets you import data from banks and other financial institutions, but this is a manual process. It doesn’t integrate with them nor does it have encryption or password protection.

The software provides a simple user-friendly interface for managing your accounts, including checking, savings, and credit cards. It also includes tools for tracking your investments, including stocks, bonds, and mutual funds.

It’s a bit more limited than the likes of Quicken but is completely free and perfect as a personal checkbook software for Windows. The only issue is it’s no longer officially supported by Microsoft and must be downloaded from a third-party site or the Wayback Machine.

Pros:

- Free to use indefinitely on Windows 8 through 10

- Intuitive interface

- Tracks investments

Cons:

- Microsoft no longer offers support for the software

- Lacks real-time integration with your banks and accounts

- Cannot handle payments directly through the software

Get Microsoft Money Plus Sunset Deluxe

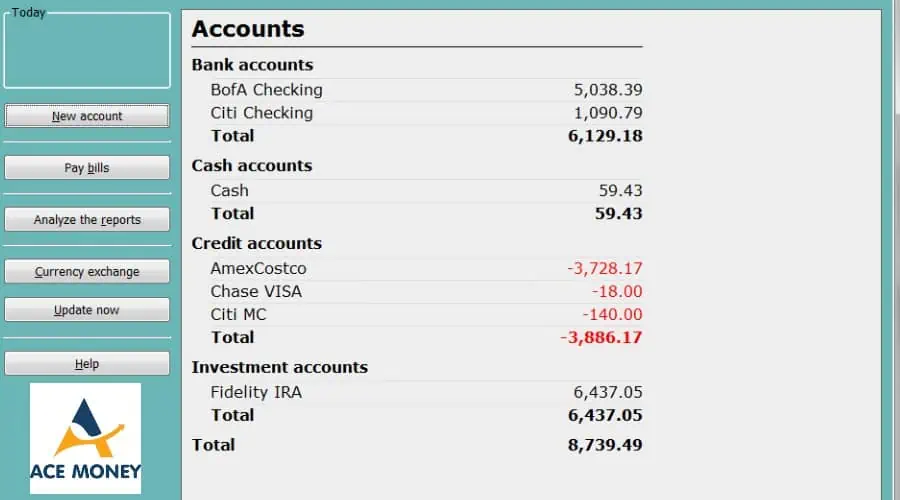

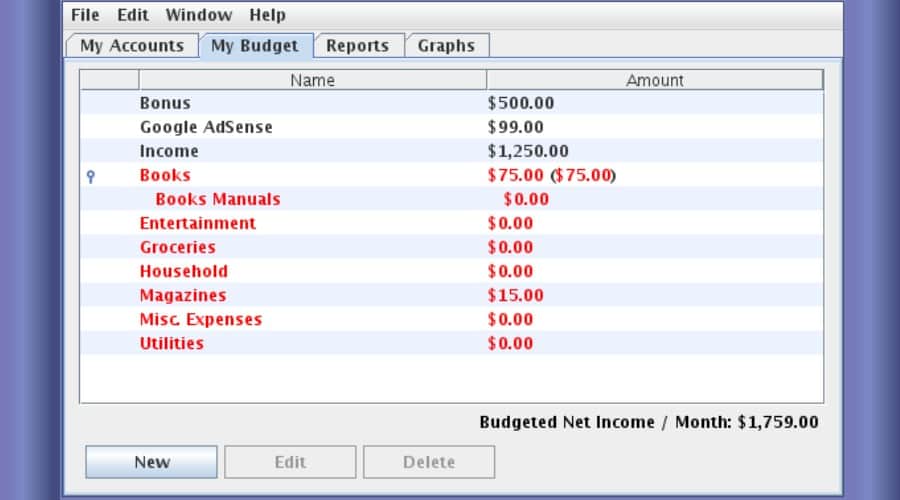

8. AceMoney

AceMoney for Windows lets you manage multiple accounts, including checking, savings, credit cards, loans, etc. Track transactions, reconcile accounts, and view account balances all in one place. Investors can also monitor their performance over time. All is password-protected and encrypted.

The software generates reports that show your spending habits and helps you identify areas for improvement, and creates a budget to set limits for your expenses, allowing you to stay within your means.

It supports more than 150 currencies, and it’ll automatically download exchange rates.

AceMoney Lite is a basic free version of the checkbook software that supports 2 financial accounts, while the premium version for multiple accounts is $45.

Pros:

- Affordable premium plan

- Supports 150 currencies and the latest exchange rates

- Downloads account data in real-time and can make payments automatically

Cons:

- Dated interface

- Requires a more hands-on approach and lacks some automations

9. Buddi

Buddi is a free, open-source software designed for those who have little or no financial background. It offers basic features that are perfect for home users who want to keep track of their spending and budget without getting too bogged down in complex financial jargon.

Those who want more features can expand its functionality with free plugins.

The base version includes expense tracking, budgeting, and reports that give you insights into your spending habits. What’s more, it automatically updates your balances, transactions, and other financial data in real-time via the encrypted open banking system.

However, you can’t make payments directly through the software.

Pros:

- Completely free and open-source

- Supports add-ons for more features

- Great for beginners

Cons:

- Limited support from the developers

- Not suitable for businesses

- Lacks auto-payments

10. Money Manager Ex

Money Manager Ex offers many of the same features as other checkbook software for Windows but with the added benefit of being free and open source. You can manage multiple accounts, including checking, credit card, savings, and investment accounts, to give you a complete picture of your finances.

Moreover, it supports scheduling recurring transactions, such as bills and paychecks, so you don’t have to enter them manually every time. The software’s visual reports give helpful insights into your spending habits and overall financial health. You can also create your own custom reports.

The main drawback of Money Manager Ex is you’ll need to import your various account data manually using one of the supported file formats (QIF, CSV, XML, etc.). However, you can secure this data with a password.

Pros:

- Cross-platform support, not just Windows

- Excels at budgeting and cashflow

- Completely free

Cons:

- Lacks real-time account integration

- QIF file support can be buggy

- The mobile interface requires zooming in

Whether you’re looking to balance your checkbook, track expenses, or create a budget, the best checkbook software for Windows offers a range of features to help you take control of your personal finances. Many are also suitable for businesses.

Those looking for premium advanced software should consider the likes of QuickBooks, Quicken, or AceMoney. However, there are many good free and open-source options, including Money Manager Ex, GnuCash, and Buddi.

For the least hassle, it’s best to choose Windows checkbook software that supports encryption while integrating with your accounts automatically rather than having to manually export and import the data.

User forum

0 messages