RIM imploding, may be looking for a buyer

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

It has taken a while for the penny to drop, but today RIM has pre-announced that that they expect a loss in their current financial quarter, due to “lower volumes and highly competitive pricing dynamics in the marketplaceâ€

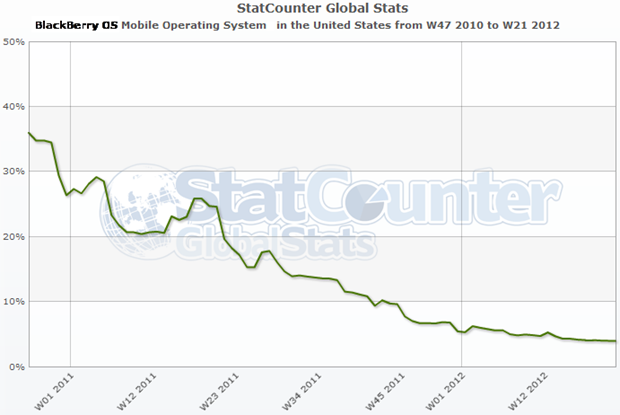

As the Statcounter graph clearly shows, the company has been losing market share sharply and steadily for more than a year now, as their competitive position in terms of operating system and ecosystem gets rapidly eroded.

The company also announced they would be making significant cuts in staffing (up to 38%) and have “engaged J.P. Morgan Securities LLC and RBC Capital Markets to assist the Company in reviewing RIM’s business and financial performance and to evaluate the relative merits and feasibility of various financial strategies, including opportunities to leverage the BlackBerry platform through partnerships, licensing opportunities and strategic business model alternatives.â€

The company’s current range has been selling slower than expected, with their internal inventory increasing by two-thirds in the past year because of slumping sales of Blackberries and Playbooks.

“Clearly this stuff isn’t selling,†said Monga, who maintains a buy recommendation on RIM’s stock in anticipation of the company being sold. “Despite all the writedowns they’re taking on the inventory, these inventory levels are not dropping.â€

“There’s their own inventory buildup and then there’s the inventory with carriers and retailers,†said Sameet Kanade, an analyst at Northern Securities Inc. in Toronto, who recommends selling RIM shares. “It’s more than likely there will be a writedown.â€

Sales will not have been helped by RIM’s announcement that current phones will not be upgradable to their new operating system, effectively Osborning their current range.

“Until you have a new product, there’s nothing to transition to,†said Colin Gillis, an analyst at BGC Partners LP in New York , who advises selling RIM’s stock. “It’s still very much in the early stages.â€

RIM’s current performance mirror’s Nokia’s from last year, and it is likely even when their new range is released they will also face a long battle back to relevance, all the time providing an opportunity for competitors to feast on their still-breathing carcass.

Via TNW and Bloomberg Business Week.

User forum

0 messages