Morgan Stanley increase their Nokia holdings by 700% in Q2

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Jacob Steinberg, a contributor at Seeking Alpha has done some interesting detective work regarding the institutional holding of shares in Nokia.

He found that, despite dire warnings by various analysts and banks, many institutions have actually increased their stake in the company, indicating that either they have quiet confidence in the company, or they are fleecing the smaller investors by saying one thing and doing another.

He found Goldman Sachs has increased their stake in Nokia from 61 million shares to 116 million over the last quarter, an increase of nearly 90%.

Barclays increased their stake by 115%, while Credit Suisse added 94% to their holdings.

Morgan Stanley made the biggest jump, increasing their stake by 400% to 32 million shares.

Overall in the quarter, 112 institutions increased their Nokia shares by 128 million shares, whereas 163 institutions decreased their Nokia shares by 77 million shares. In net, the institutional ownership of Nokia increased to 17%.

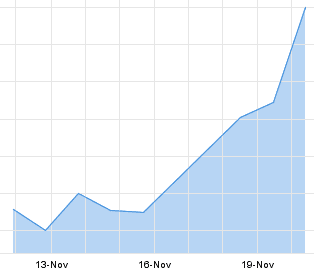

The company has a had a recent massive run up on news of early sales success of their new flagship, the Nokia Lumia 920, and is today trading in Europe at EUR 2.56, up nearly 82% from their July low of around 1.404 Euro.

We are not qualified to give trading advice, but it seems those that are are not in fact afraid to buy into Nokia.

Read more at Seeking Alpha here.

Via Reddit.com

User forum

0 messages