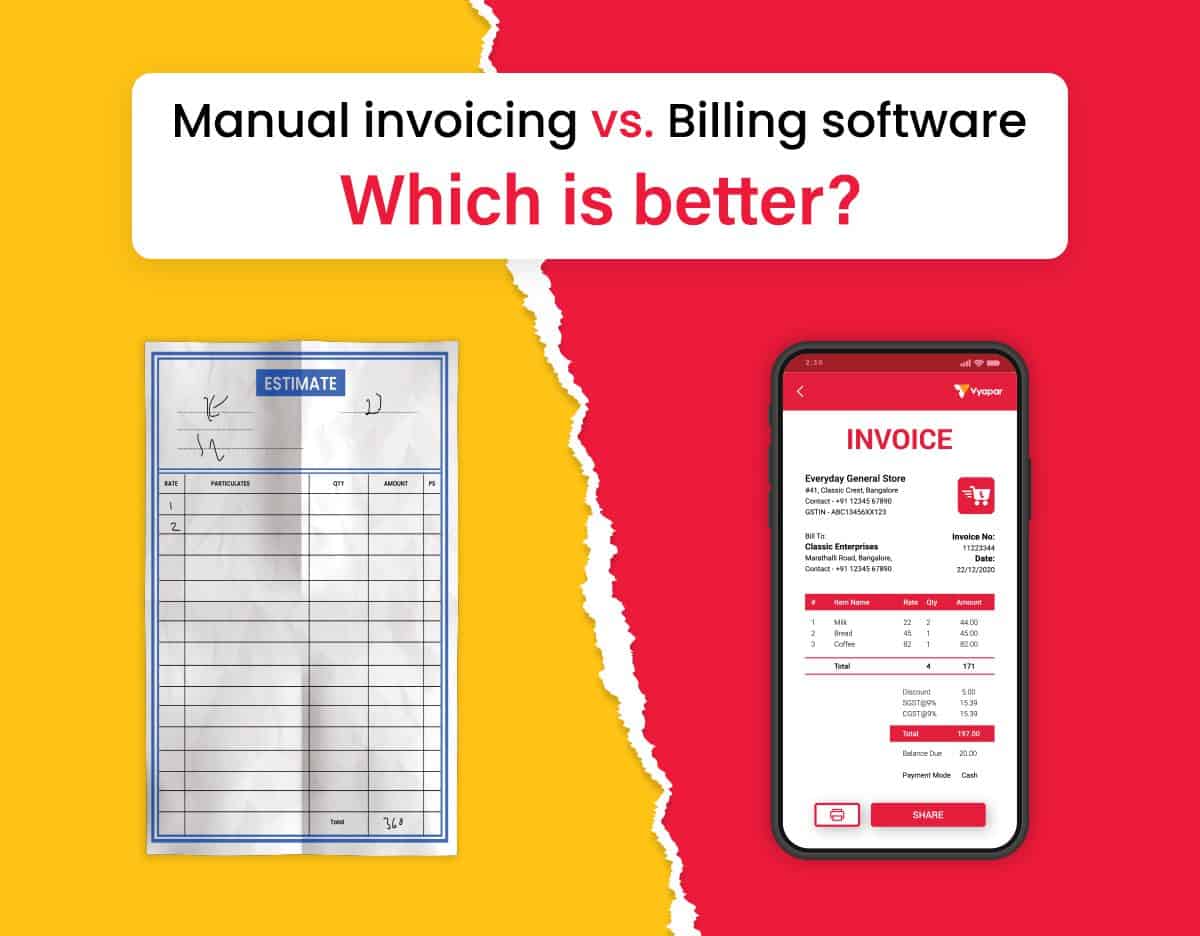

Manual invoicing vs. Billing software: which is better?

4 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Sponsored

Enterprises often perform their invoicing by hand since they don’t have well-defined systems in place at the outset of their ventures. This may need starting from scratch when preparing a paper invoice. It might also require downloading and manually altering word documents or spreadsheet invoice templates. Email attachments are then sent out as a result of this process.

Imagine for a moment that you are the owner of one of these modern businesses. Handling invoicing by hand becomes more time-consuming and prone to mistakes as your business grows. This is where automatic invoicing comes in. Automated invoicing is the practice of automatically generating and sending invoices to customers using billing software.

Here, we’ll compare and contrast manual invoicing done using downloadable invoice templates with automated invoicing done with a billing app to explain to you exactly which is best for your business.

What’s manual invoicing?

There are two types of manual invoicing: spreadsheet and word processor template-based processes. It’s an entirely original concept.

Each template, including the sender and recipient’s names, must be filled out in the invoice before it can be delivered.

So are the digital tools, which are linked to both manual and electronic billing methods. As a result, a comprehensive strategy isn’t necessary because several payment channels may be integrated. However, neither the payment reminders nor the reports may be adjusted in real-time. The manual process requires a significant investment of time.

What’s billing software?

The billing app helps with account receivables. An invoice with specifics about the goods sold or the services given may be generated using this tool easily. When it comes to managing the company’s finances, it’s important to pay attention to the tiniest things.

The billing software has a variety of pre-built templates that make it simple to handle. Users may also easily send these invoices to others by clicking a button.

Invoicing software vs. manual invoicing: Learn the difference!

This section is dedicated to explaining the key aspects that distinguish the two invoices:

Automation:

During the manual invoicing process, it is up to the accountant or another individual to prepare the invoice and ensure all pertinent facts are included. On the other hand, using the billing software will put a stop to this practice. Because the software has been updated with all of the information, it will be able to create the invoice in a short time.

Manual monitoring:

When using the manual invoicing approach, it is essential to follow up on any issues that may arise manually. The person running the firm is responsible for doing manual follow-ups with their customers about payments. However, with the assistance of a billing app, payment reminders may be established, and they will be sent out to consumers in an automated fashion. At predetermined intervals, the clients will be informed about the impending payments that are due to them.

Real-time reporting

When billing was done manually, the most significant challenge was the generation of the invoice when the activity was finished. There are situations when it takes the accountant a great number of days to create it. However, this problem has been solved by introducing software for generating invoices. The procedure may be completed instantly, and all the accountant has to do is describe the specifics; after that, everything can be organized in a short amount of time.

Online payment:

When invoices are generated manually, there is no way to integrate third-party payment apps. However, if you use a billing app, it will be much simpler to connect any third-party programs that are necessary for collecting payments. To put it another way, the firm was able to collect payments promptly thanks to the use of invoicing software, which made the process quite straightforward.

You still have a lot of options to investigate when it comes to accessible invoicing software. Right now, customers may make use of a service called Invoice Office, which simplifies the process.

Conclusion

The majority of company owners are beginning to include automated billing software in their operations. Sometimes industry-specific software is the greatest option, while other times a universal solution that gives everything is the best option.

Your company’s needs, workflow, and accounting procedures will all play a role in the software for online invoicing that you end up selecting. The software that handles your customers’ information will meet your requirements for generating invoices.

While you are in the process of picking the software for billing and invoicing, we strongly suggest that you compare all of the essential items that are required for your company.