Here are the Kantar smartphone market share numbers for August 2016

4 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

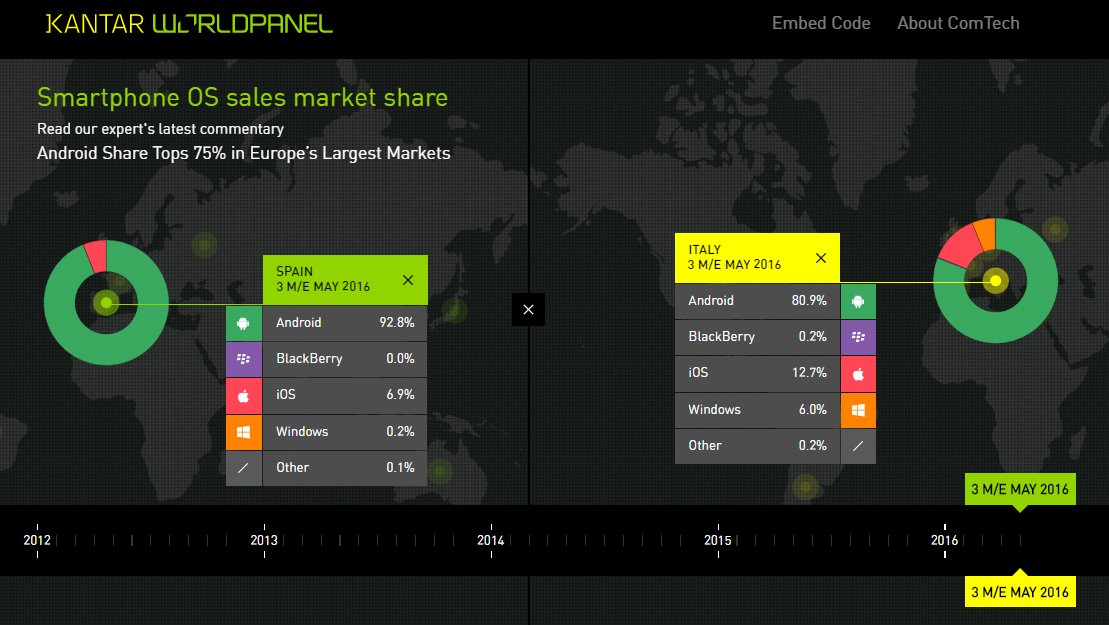

Kantar has released their smartphone market share numbers for the 3 months ending August 2016.

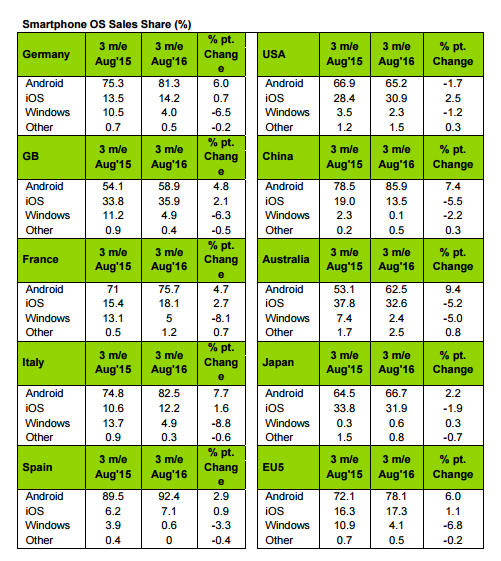

We won’t delve too far into the numbers. European market share for Windows Phone overall is 4.1%, slight down from 4.2% in July 2016, with the strongest markets being France, Germany, Italy and UK. Of note is that market share in Japan appears to have doubled.

Kantar notes:

The latest smartphone OS data from Kantar Worldpanel ComTech shows that for the three months ending August 2016, market share for both Android and iOS grew in EU5, representing 78.1% and 17.3% of smartphone sales, respectively. In the US, iOS increased 2.5 percentage points to 30.9%, but declined in Urban China, falling to 13.5% of smartphone sales. Android dropped 1.7 percentage points in the US.

In the US, Android accounted for 65.2% of smartphone sales, a decline from 66.9% in the same period a year ago. Android’s three largest manufacturing brands in the US – Samsung, LG, and Motorola – all posted year-on-year sales declines, with Samsung continuing as the top manufacturer in the region at 33.9% of smartphone sales.

“Alcatel and ZTE, sold primarily through prepaid channels such as Walmart and Boost Mobile, each captured 3.5%, gaining an average of two percentage points in US market share over the past year. That growth, however, was not enough to offset the decline experienced by other Android brands,” said Lauren Guenveur, Consumer Insight Director for Kantar Worldpanel ComTech.

“In Great Britain, both Android and iOS continued to enjoy year-on-year gains, with the iPhone SE remaining the top smartphone sold in the region in the three months ending August 2016,” reported Dominic Sunnebo, Business Unit Director for Kantar Worldpanel ComTech Europe. “In Germany, eight out of every ten smartphones sold was Android-based. Samsung remains the top brand at 46%, although that number represents a decline of 3.6 percentage points, compared to the August period a year ago. The Samsung Galaxy S7 was the top-selling device, with a starting price of €620, closely followed by the Samsung Galaxy A5 and A3, two lower-cost alternatives to Samsung’s flagship device.”

“The US, British and German markets have a couple of things in common. First, the Google Pixel, announced October 4, will be available through select retail partners in these markets beginning in mid-October. Second, the combined sales shares of Samsung and Apple represent more than 60% of all smartphones sold in these regions, with the rest scattered among brands in decline, such as Motorola and Sony, and those in growth, like Huawei and Alcatel,” Guenveur added. “The US and Britain have always been considered premium markets, but we are starting to see a shift to lowercost devices as the prices of flagship products reach upwards of $800. For Google, this represents a unique challenge, as consumers weigh the features of the Pixel against those of other similarly priced products like the iPhone 7 and Galaxy S7, and against ‘good value for money’ Android-based brands that many consumers have started to view as alternatives.”

“In Urban China, iOS accounted for 13.5% of smartphone sales in the three months ending August 2016, the lowest share for iOS since before the launch of the iPhone 6 and 6 Plus in July 2014,” said Tamsin Timpson, Strategic Insight Director at Kantar Worldpanel ComTech Asia. “Android accounted for nearly nine out of every ten smartphones sold, with Huawei and Xiaomi remaining the top two brands in the region. Oppo, close on Apple’s heels, accounted for 10.6% of sales, with the Oppo R9 becoming the second best-selling phone in the region at 4%, behind the iPhone 6s at 4.3%.”

“We believe that Apple’s share in Urban China will bounce back, as the iPhone 7 and 7 Plus become widely available,” Guenveur explained. “Our September 2016 data is expected to show that initial iPhone 7 sales plus a boost from the lower-priced iPhone 6s and 6s Plus will begin to reverse iOS share decline that began in February. However, with Huawei continuously breaking its own record for the highest share in China – currently 30% of smartphone sales – there is no guarantee that Apple will return to the number one position in that market.”

User forum

0 messages