After best growth since 2010, Canalys says "PCs are here to stay."

3 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

One of the unexpected consequences of the COVID-19 pandemic has been a resurgence of the PC market, due to the need to work and learn from home.

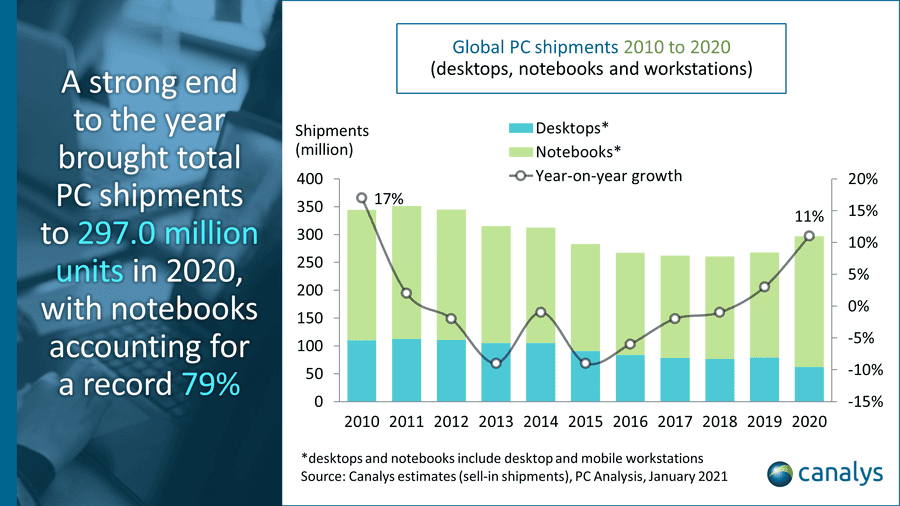

Canalys reports this has resulted in the strongest growth in the PC market since 2010, and the highest shipment volume since 2014.

90.3 million PCs, mostly laptops, were shipped in Q4 2020, meaning a total of 297.0 million units were sold for the whole of 2020. Shipments of laptops and mobile workstations increased by 44% from 2019 to reach 235.1 million units while desktop and desktop workstation shipments fell 20% from last year to reach 61.9 million units in 2020.

Lenovo held first place in the PC market in Q4 with record shipments of 23.1 million units and year-on-year growth of 29%. This meant it also took first place for the whole year, with total shipments of 72.6 million units and a market share of 24.5%. HP took second place in the annual rankings, with Q4 shipments of 19.1 million units, bringing its 2020 total to 67.6 million units, up 7% over its 2019 number. Third-placed Dell ended 2020 with a bang, with Q4 shipments up 27% to break the 15-million mark for the first time in its history, bringing its 2020 total to 50.3 million units. Apple and Acer took fourth and fifth place, shipping 22.6 and 20.0 million devices, respectively. In total, the top five vendors accounted for 78.5% of PC shipments in 2020.

| Worldwide desktop, notebook and workstation shipments (market share and annual growth) Canalys PC Market Pulse Q4 2020 |

|||||

| Vendor (company) | Q4 2020 shipments |

Q4 2020 market share |

Q4 2019 shipments |

Q4 2019 market share |

Annual growth |

| Lenovo | 23,122 | 25.6% | 17,906 | 24.9% | 29.1% |

| HP | 19,130 | 21.2% | 17,392 | 24.1% | 10.0% |

| Dell | 15,794 | 17.5% | 12,441 | 17.3% | 27.0% |

| Apple | 7,180 | 8.0% | 4,951 | 6.9% | 45.0% |

| Acer | 6,151 | 6.8% | 4,439 | 6.2% | 38.6% |

| Others | 18,918 | 21.0% | 14,897 | 20.7% | 27.0% |

| Total | 90,295 | 100.0% | 72,026 | 100.0% | 25.4% |

| Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), January 2021 |

|||||

“2021 is shaping up to be an even more exciting year for PCs, with vendors and ecosystem players refusing to rest on their laurels as they compete for the new demand opportunities that have emerged in 2020,” said Ishan Dutt, Analyst at Canalys. “Innovations in chipsets, operating systems, connectivity and form factors will take center stage as the PC industry caters to a broader range of customers that bring with them new behaviors and use cases. From Apple and Microsoft’s new custom silicon to the exciting platform updates to Chrome and Windows, the PC industry is moving at breakneck speed to cater to its newfound user base. While supply shortages continue to dampen the market in the short term, Canalys believes most wrinkles will be ironed out by the second half of 2021.”

See the whole report at Canalys here.