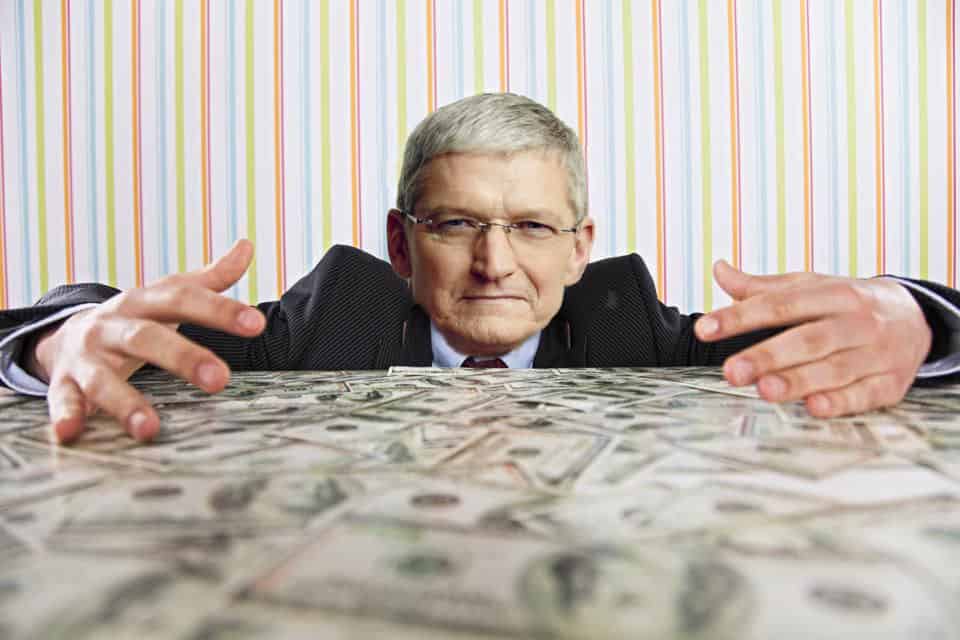

A 5-year-old Tim Cook's statement costs Apple half a billion dollars

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Key notes

- Apple settled a shareholder lawsuit for $490 million over alleged misleading statements about the demand for iPhones in China.

- The lawsuit claims CEO downplayed slowing sales in China despite Apple later slashing production and revising revenue forecast.

- Apple denies wrongdoing but settles to avoid further legal costs.

Apple reached a settlement agreement of $490 million with shareholders who filed a class-action lawsuit against the company. The lawsuit alleged that CEO Tim Cook misled investors regarding the true state of iPhone demand in China.

According to market tracker IDC, Apple’s iPhone unexpectedly emerged as the best-selling smartphone series in China for 2023. But there was a special sale in China by Apple. Analysts suggest the move could be motivated by several factors, such as the slow sales of the iPhone 15 in China, which have been slower than its predecessor’s. This may be due to increased competition from local smartphone brands like Huawei.

The case centered around comments made by Cook during an analyst call in November 2018. While acknowledging sales pressure in certain markets due to weakened currencies, Cook reportedly downplayed concerns about China.

However, just days later, Apple reportedly instructed suppliers to reduce production, predicting a significant drop in iPhone sales within the region. This news caused Apple to unexpectedly slash its quarterly revenue forecast in January 2019, citing U.S.-China trade tensions as the primary factor. The announcement resulted in a 10% plunge in Apple’s share price, wiping out an estimated $74 billion in market value.

The shareholders involved in the lawsuit claimed that Cook’s statements, along with Apple’s actions regarding production cuts, constituted a misrepresentation of the company’s financial health. They argued that investors were misled and suffered financial losses due to this lack of transparency.

Apple has consistently denied any wrongdoing throughout the legal proceedings. However, the company opted to settle the lawsuit to avoid the prolonged costs and potential reputational damage associated with further litigation.

The case is In re Apple Inc Securities Litigation, U.S. District Court, Northern District of California, No. 19-02033.

More here.

User forum

0 messages