IDC says PC shipments grew for the first time in 6 years this holiday season

3 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

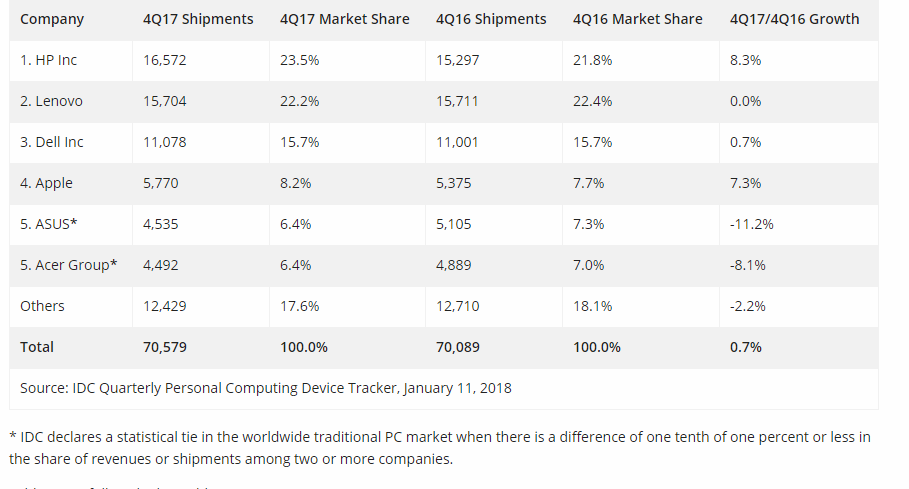

The IDC reports PC sales were better than expected in Q4 2017, with shipments actually growing 0.7% YoY instead of declining 1.7% as expected. A total of 70.6 million traditional PCs (desktop, notebook, and workstation) were shipped.

A total of 259.5 million PCs were shipped in 2017, supported by commercial upgrades and some pockets of improving consumer demand. Growth in demand was noted in Asia/Pacific (excluding Japan) (APeJ) and Latin America, with Europe, the Middle East and Africa (EMEA) stable due to growth in the sales of notebooks and an upgrade cycle in business, and USA challenging with a decline in both notebooks and desktops and a total of 16.5 million units sold. Japan was a stand-out case with its sixth consecutive quarter of year-over-year growth, achieving year-over-year growth of 3.8% versus the forecast of a 2.9% decline in shipments. The commercial segment seems to be driving this growth due to rising demand from Windows 10 migration (and the end of support for Windows 7 scheduled for Q1 2020).

Noticeable was companies making their products more appealing to profitable niches such as the slim and light and gaming segments.

“The fourth quarter results showed some potentially encouraging headway against the difficult environment in retail and consumer PCs,” said Jay Chou, research manager with IDC’s Personal Computing Device Tracker. “Enticed by a growing array of products that promise all-day battery life, high portability, and address emerging use cases that require more compute power, pockets of the consumer base are taking a serious look at these revamped PCs. However, the overall PC market remains a challenging one.”

“The solid holiday consumer sales provided enough momentum for the PC market to stabilize a bit further,” said Neha Mahajan, senior research analyst, Devices & Displays. “However, the growing popularity of other mobile form factors continued to have a dampening effect and led the overall U.S. PC market to perform below expectations.”

In terms of individual companies, HP Inc. pulled further ahead as the top company, maintaining its lead through every quarter of 2017. Shipments grew 8.3% compared to a year ago for the seventh consecutive quarter of positive growth and volume hit more than 16 million units for the first time since the third quarter of 2011. HP further consolidated its position in the U.S. market, growing its market share to 34%.

Lenovo was the number 2 company in 4Q17 with a flat quarter compared to 4Q16. It continued to weather tough conditions in the U.S. as it works through management transitions and channel changes. Outside of the U.S., Lenovo made solid gains growing 3.9% year over year with solid notebook shipments during the quarter.

Dell Inc. held the third position in 4Q17, posting year-over-year growth of 0.7% and shipping more than 11 million units for the first time in 2017. Competition in the U.S. market remained tough for the company as its U.S. share and growth both suffered. Elsewhere the company saw solid numbers.

Apple remained in the fourth position and grew its shipments 7.3% in 4Q17.

ASUS and Acer finished the fourth quarter in a statistical tie for the fifth position. ASUS saw its shipments decline 11.2% year over year in 4Q17. Meanwhile, Acer’s focus on gaming PCs and related products, as well its presence in Chromebooks, helped it to close the gap with ASUS, despite a year-over-year decline in shipments.

Do our readers think the stabilization of the PC market in 2017 was a blip or has the segment defied predictions of its eventual demise? Let us know below.

Via Winfuture.de

User forum

0 messages