Tesla earnings manage to beat already sky-high expectations, S&P500 inclusion beckons

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Tesla is the most valuable car company in the world, but much of that status depended on how the company did in the last quarter, with the tantalising hope of a full year of profitability being in reach.

Investors will be more than satisfied therefore after the company managed to deliver in spades.

Today, Tesla announced $6 billion in revenue and a small profit of $0.50 per share (GAAP) in Q2 2020. This beat analyst expectation of $5.146 billion in revenue and a loss of $0.14 per share.

The small profit is more than symbolic – it could potentially allow Tesla’s admission into the S&P 500, which is expected to drive further gains in Tesla’s already stratospheric share price.

Net profit was $104M GAAP net income, $451M non-GAAP, with Tesla saying in their earnings release:

“Our operating profit improved in Q2 despite challenging circumstances. Positive impacts included lower operating costs due to a temporary reduction in employee compensation expense, a sequential increase in regulatory credit revenue and deferred revenue recognition of $48M related to a Full Self Driving (FSD) feature release. These positive contributions were offset by significant costs related to factory shutdowns, as well as a sequential increase in non-cash SBC expense primarily attributable to $101M related to 2018 CEO award milestones.”

Despite the challenges, Tesla managed to increase its gross margin and cash position.

The performance was on the back of selling 90,650 cars, up from 88,000 in Q1 2020, despite the pandemic, but the profit was largely due a massive $428 million regulatory credit for their non-polluting vehicles.

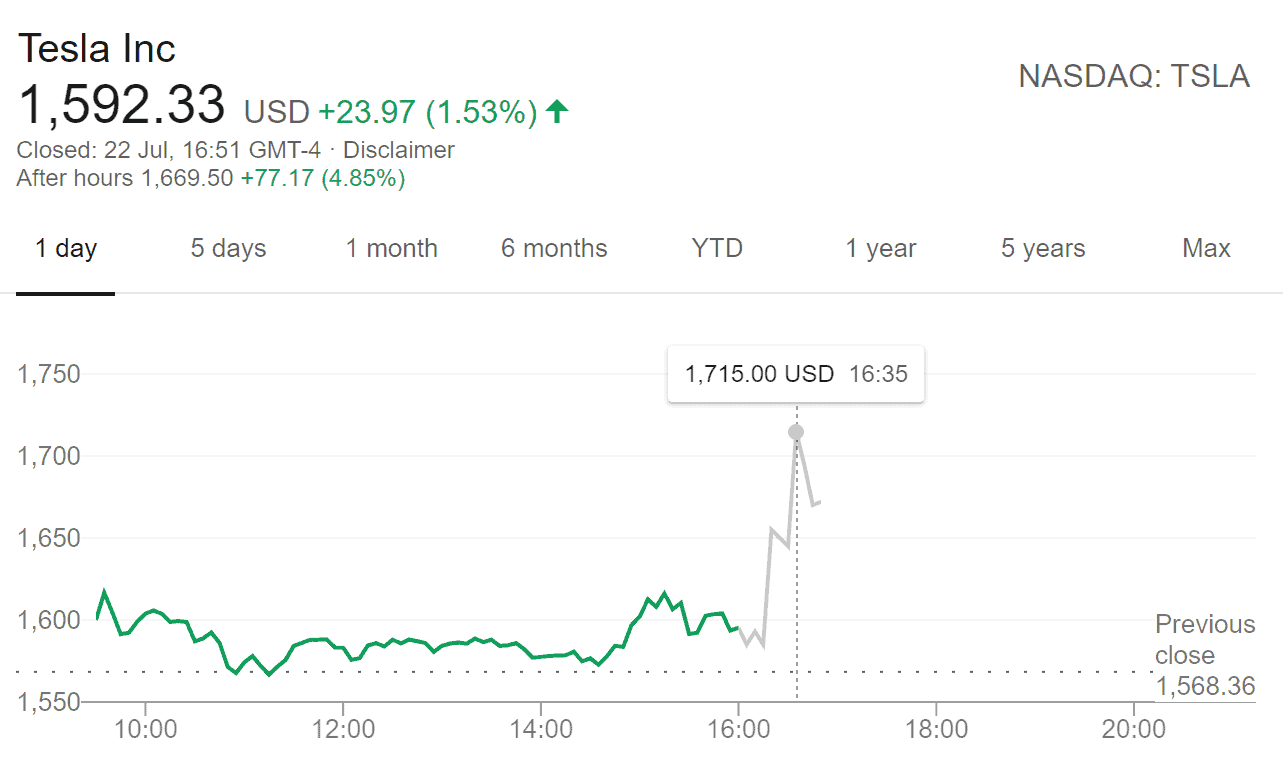

In response, Tesla’s share price spiked 7% after hours, testing a new all-time high of $1,715 per share.

See the full release here.

Via Electrek

User forum

0 messages