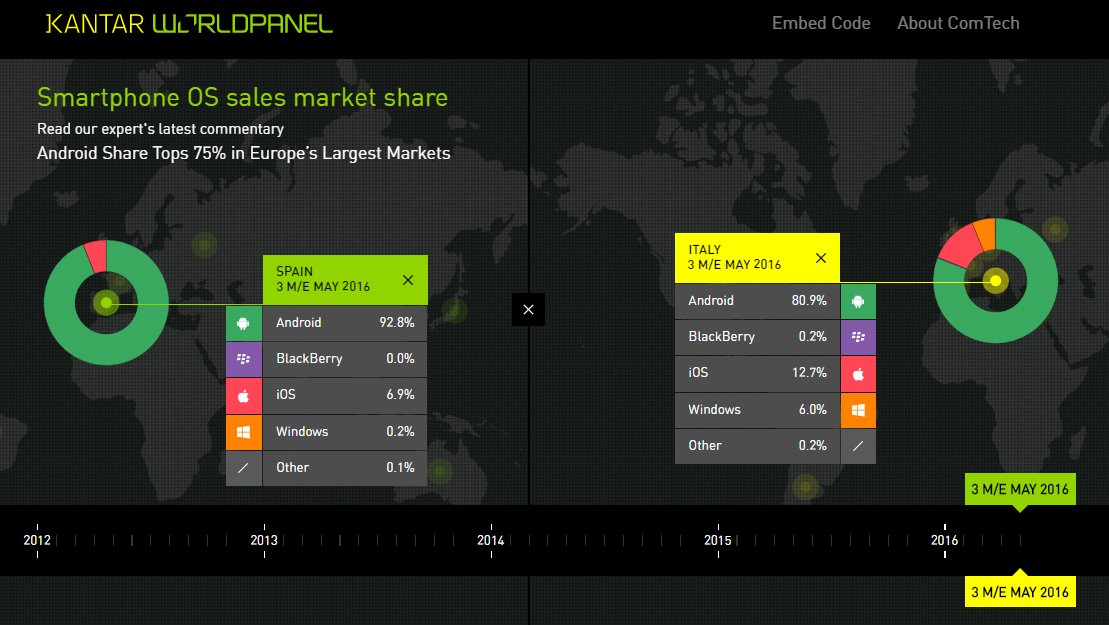

Here are the Kantar smartphone market share numbers for November 2016

4 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

For smartphone market share watchers, here are analyst company Kantar’s latest numbers for the smartphone market share for the 3 months ending November 2016.

The numbers show iOS and Android made gains across EU5, largely due to the decline of Windows. The best showing for iOS was in in GB where it was up 9.1 percentage points for the year ending in November 2016. Windows Phone has somewhat of a mixed picture compared to last month, but continues to fade overall, dropping to 2.8% of the market compared to 3.2% last month and 6.9% last year.

Kantar notes:

The latest smartphone OS sales data from Kantar Worldpanel ComTech shows Android sales declined in the US, GB, and France, as iOS continued to make gains across most regions in the three months ending November 2016. For Android, this marks the sixth consecutive period of decline in the US, at 55.3% of all smartphone sales, down from 60.4% in the same period a year earlier. In Urban China, iOS was down year-on-year at 19.9%, but continued strong period-on-period growth with sales from iPhone 7.

iPhone 7, iPhone 7 Plus, and iPhone 6s were the three most popular smartphones in the US at the beginning of the holiday period, for a combined 31.3% share. The Samsung Galaxy S7 and S7 edge were the fourth and fifth best-selling phones in the US, with Samsung capturing 28.9% of smartphone sales.

“Verizon booked nearly a quarter of all US smartphone sales during the Black Friday period, playing a vital role for all brands, including Apple and Samsung,” reported Lauren Guenveur, Consumer Insight Director for Kantar Worldpanel ComTech. “Buyers were motivated by Verizon’s promotions on both Apple and Samsung’s top phones, including offers of free iPhone 7, 7 Plus and Galaxy S7 phones after trade-in and purchase requirements were met.”

Although Android decreased in the US over the past year, the brand new Pixel phone by Google made strong gains, rising to 1.3% of sales in the three months ending November 2016, with more than half of that business done through Verizon.

Android Continues its Dominance in China

In China, iOS was down year-on-year to a 19.9% share in Urban China, dropping from 25.3% in the same period in 2015. However, growth for iOS was up 2.8 percentage points over the previous three-month period, driven by sales of iPhone 7.

“Nearly 80% of all smartphones sold in Urban China during the three months ending November 2016 were Android, as local brands continued to dominate the market,” said Tamsin Timpson, Strategic Insight Director at Kantar Worldpanel ComTech Asia. “Huawei represented 25% of all sales, but its share declined 3.1 percentage points from the three-month period ending October 2016, marking only its second period of decline in more than two years.”

Oppo posted strong growth in China with 12.9% of smartphone sales, signaling the first potential shift in the market since Huawei overtook both Apple and Xiaomi in the second quarter of 2015. Importantly for iOS and Apple, iPhone 7 became the best-selling device in Urban China at 6.6%, pushing Oppo R9 to second place at 4.7%.

Apple Market Share Mostly Positive in EU5

iOS and Android made gains across EU5, largely due to the decline of Windows. The best showing for iOS was in in GB where it was up 9.1 percentage points for the year ending in November 2016.

“In the EU5 countries, Android accounted for 72.4% of smartphone sales during this period, with iOS at 24.6%, a strong year-on-year uptick for both ecosystems as Windows’ share declined to 2.8%. For Android, this represented a 2.8 percentage point decline from the October period, while strong sales of iPhone 7 boosted iOS,” explained Dominic Sunnebo, Business Unit Director for Kantar Worldpanel ComTech Europe. “The holiday period is always strong for Apple, but it remains to be seen if demand for the latest devices will level out in the first quarter of 2017.”

Europe’s big five markets include Great Britain, Germany, France, Italy, and Spain.

User forum

0 messages