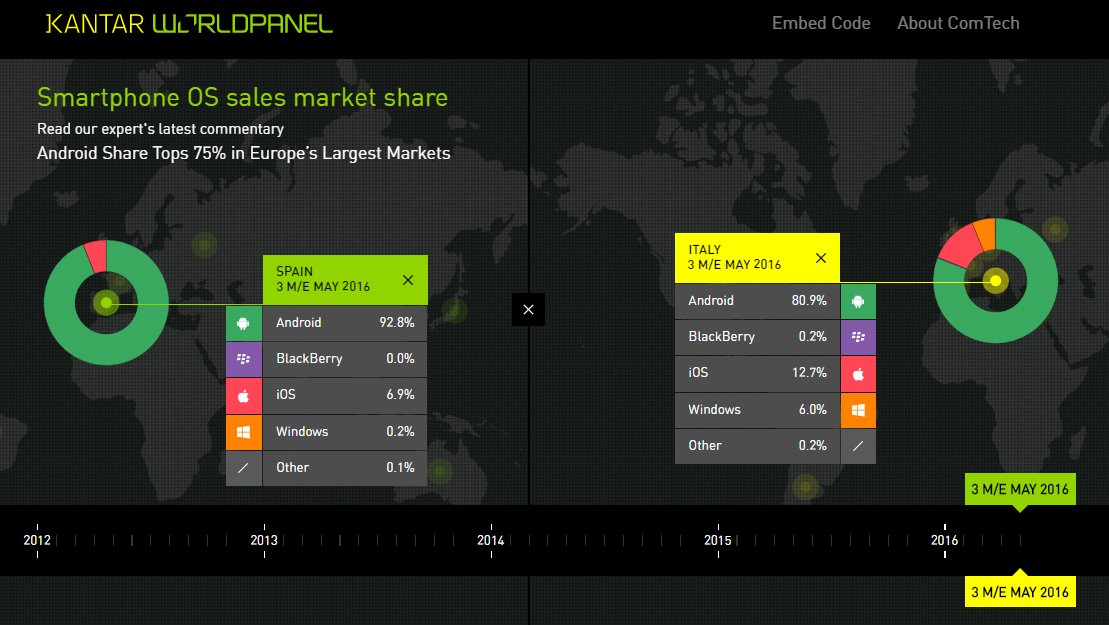

Here are the Kantar smartphone market share numbers for March 2017

4 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

For smartphone market share watchers, here are analyst company Kantar’s latest numbers for the smartphone market share for the 3 months ending March 2017.

The numbers show Windows Phone testing new lows in Europe and UK in particular, and iOS showing growth in USA while seeing dramatic drops in market share in China.

Kantar notes:

The latest smartphone OS data from Kantar Worldpanel ComTech reveal that in the first quarter of 2017, and despite an Apple earnings report that did not meet Wall Street’s expectations for iPhone sales, the company continued to make year-on-year share gains across most markets except urban China. The greatest increase for iOS came in Great Britain with 40.4 percent of smartphone sales, an increase of 5.6 percentage points, and in the US, with 38.9 percent of smartphone sales, an increase of 5.2 percentage points year-over-year.

“The first quarter of 2017 produced the lowest iOS share in China since the second quarter of 2014 with 12.4 percent of smartphone sales. Android continued to make year-on-year gains with 87.2 percent of smartphone sales,” said Lauren Guenveur, Consumer Insight Director for Kantar Worldpanel ComTech. “For iOS, this represents a 8.6 percentage point drop from the first quarter of 2016. At the same time, iPhone 7 remained the best-selling device in urban China with 3.8 percent of a market that has become increasingly fragmented.”

“As a percentage of Android sales, Huawei continued to dominate in urban China at 36 percent. Oppo, which took the Chinese market by storm in 2016, has become the second largest Android brand with 13 percent of sales. Samsung fell to sixth place behind local Chinese vendors Xiaomi, Meizu, and Vivo, at just five percent of sales,” reported Tamsin Timpson, Strategic Insight Director at Kantar Worldpanel ComTech Asia. “Oppo’s strength is in its brick-and-mortar presence, which accounts for 86 percent of their smartphone sales. This contrasts with most other brands in the market who all make at least a third of their sales online, except for Vivo.”

In EU5, Android accounted for 76.3 percent of smartphone sales in the first quarter of 2017, nearly on par with a year earlier at 75.6 percent. iOS posted a 1.9 percentage point gain to reach 20.7 percent of smartphone sales.

Europe’s big five markets include Great Britain, Germany, France, Italy, and Spain.

“Across EU5, Chinese brands have grown over the past year to account for 22 percent of smartphone sales,” said Dominic Sunnebo, Business Unit Director for Kantar Worldpanel ComTech Europe. “Huawei, the second largest Android brand across France, Italy, Germany, and Spain, has also started to make its presence known in Great Britain, where it has historically struggled. Huawei accounted for 6.3 percent of smartphone sales in Great Britain in the first quarter of 2017, an all-time high, making it the third-largest Android brand in that market behind Samsung and Sony.”

In the US, Android accounted for 59.2 percent of smartphone sales, compared to 63.4 percent a year earlier, while iOS captured 38.9 percent of sales, up year-on-year from 33.7 percent. The drop in Android share has been driven largely by lower sales of Samsung and Moto phones, the largest and third-largest Android-based brands in the market.

“While Chinese vendors are enjoying growth in places like EU5, Latin America, and India, the same cannot be said in the US, which remains dominated by Apple (39%), Samsung (30%), and LG (12%),” Guenveur said. “The first quarter 2017 decline in Samsung smartphone sales was likely due to buyers anticipating the April 21 release of the new Samsung Galaxy S8. We expect to have launch results for the S8 within the next 60 days. We should also learn if the S8 will overcome Samsung’s troubles with the Note 7, and whether the S8 will push the iPhone 7 and 7 Plus out of the top-selling spot.”

User forum

0 messages