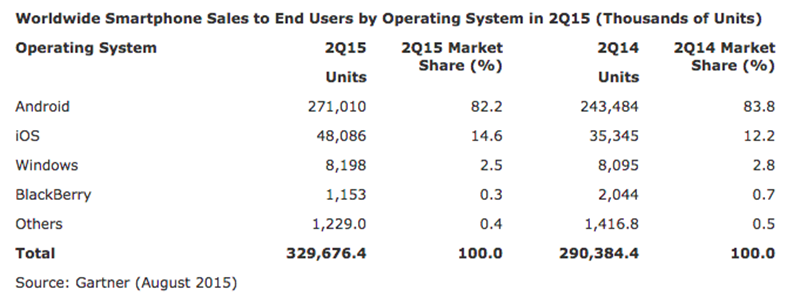

Gartner award Microsoft 2.5% market share in Q2 2015

3 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Gartner has released is Q2 2015 estimates of worldwide smartphone saes today.

The analyst company has awarded Microsoft 8,198 million device sales in the quarter, for a 2.5% market share, down from 2.8% a year ago.

Unlike IDC Gartner touts its numbers as representing sell through to end users, meaning more than 8 million new handsets are in the hands of Windows Phone fans.

The numbers are flat from last year, with only around 1% growth year on year, and the only saving grace for Windows Phone was that the smartphone market itself hardly grew, with only 330 million handsets sold in Q2 2105, representing only 13.5% growth.

“While demand for lower-cost 3G and 4G smartphones continued to drive growth in emerging markets, overall smartphone sales remained mixed region by region in the second quarter of 2015,” said Anshul Gupta, research director at Gartner.

Emerging Asia/Pacific (excluding China), Eastern Europe and Middle East and Africa were the fastest-growing regions, driven by good performance from Chinese and local vendors.

By contrast, smartphone sales in China fell for the first time year over year, recording a 4 percent decline.

“China is the biggest country for smartphone sales, representing 30 percent of total sales of smartphones in the second quarter of 2015. Its poor performance negatively affected the performance of the mobile phone market in the second quarter,” said Mr. Gupta. “China has reached saturation — its phone market is essentially driven by replacement, with fewer first-time buyers. Beyond the lower-end phone segment, the appeal of premium smartphones will be key for vendors to attract upgrades and to maintain or grow their market share in China.”

The growth rate is the slowest since 2013 and unusually do not coincide with an economic downturn.

“China is the biggest country for smartphone sales, representing 30 percent of total sales of smartphones in the second quarter of 2015. Its poor performance negatively affected the performance of the mobile phone market in the second quarter,” said Mr. Gupta. “China has reached saturation — its phone market is essentially driven by replacement, with fewer first-time buyers. Beyond the lower-end phone segment, the appeal of premium smartphones will be key for vendors to attract upgrades and to maintain or grow their market share in China.”

Gartner notes Apple recorded strong replacement sales, and dominated the high end, leaving other vendors competing for the mid-range and low-end scraps.

Gupta said Microsoft continued to struggle to generate wider demand for Windows Phone devices — even at the lower end.

“In light of Microsoft’s recent cuts in its mobile hardware business, we’ll await signs of its long-term commitment in the smartphone market,” he said.

Microsoft has a new generation of super-high end Windows 10 Mobile handsets on the way, but by some indications is planning to leave competing for market share to other OEMs, a difficult choice for those OEMs when iOS and Android so clearly dominate the market.

What do our readers think these numbers will look like for Windows 10 Mobile next year? Let us know below.

User forum

0 messages