EU Competition Chief on Activision deal: Authorities "cannot be in a race"

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Margrethe Vestager, European Commissioner for Competition, stressed in a recent interview that EU regulators wouldn’t rush the decision for the Microsoft-Activision merger. Vestager also commented about the UK watchdog’s “quick read” about the deal but said regulators tend to end with different results.

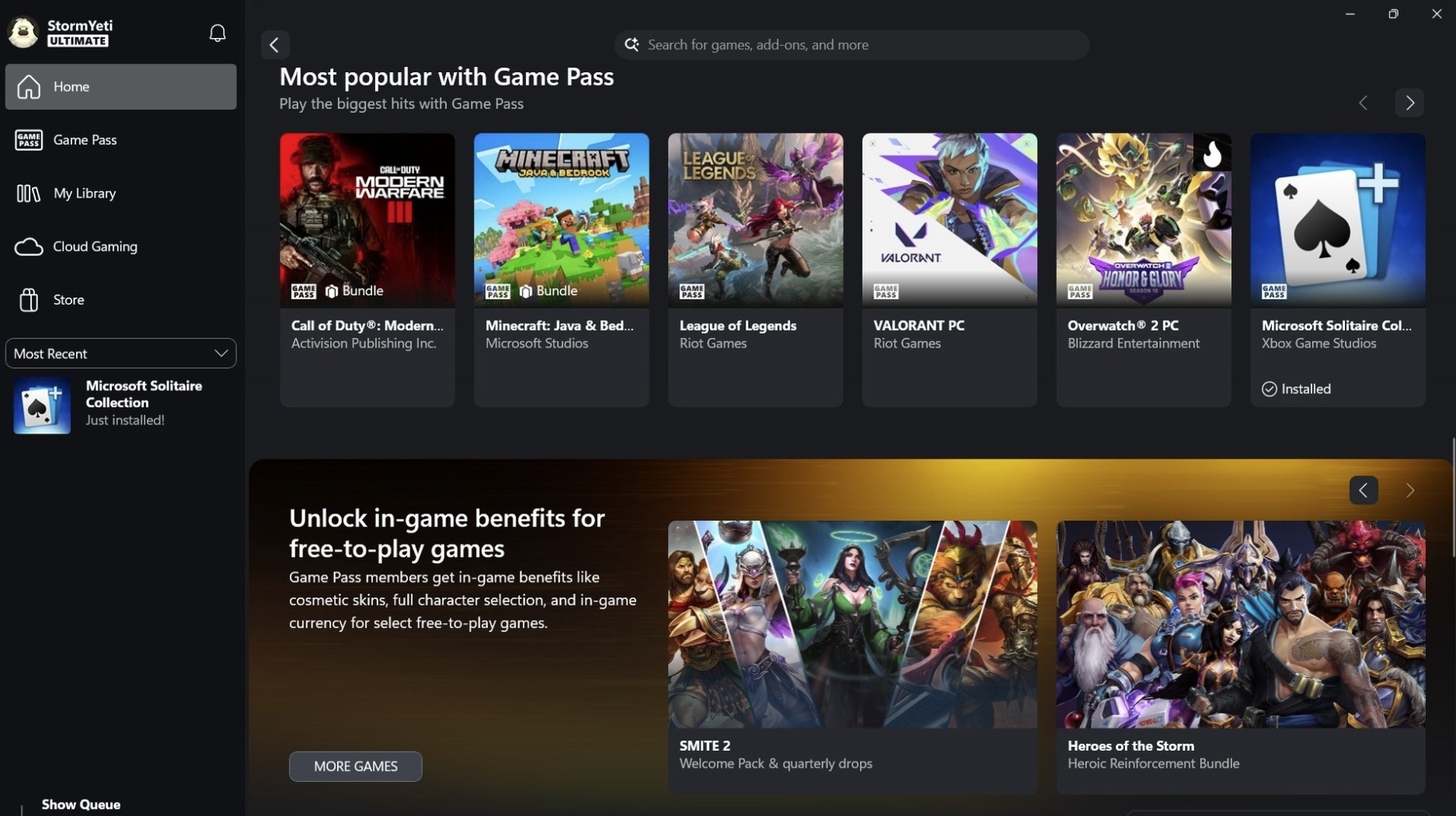

Microsoft is still fighting to persuade different competition watchdogs globally to close its proposed $69 billion Activision megadeal. EU is one of those still scrutinizing the merger and sent the software company a statement of objections, indicating its concerns about the possible anti-competitive results of the deal. Last week, Microsoft addressed the concerns by attending a closed-door hearing with European Union regulators in Brussels, where it also defended the deal. Different companies already support the deal, including Meta, Tencent, Nintendo, and Nvidia. Despite this, the EU continues to review the acquisition proposal, with Vestager recently sharing how careful the EC is in taking the process, which will be finalized by April 11.

“It is very important for me to lend an ear to all sides of this,” the commissioner told Bloomberg. “So obviously, I have meetings with a number of CEOs; not to get the passion of gaming. I’m there to sense the facts of the case.”

According to Vestager, the EC considers different factors before deciding on the deal, including the present market conditions, innovations, and more.

“I try to get the full picture because we should not be captured by any side of the debate about the effects of a merger,” she added.

The interview also covered the disapproving provisional findings UK’s Competition and Markets Authority shared recently over its own probe. When asked about the CMA’s “very quick read on the situation” and whether authorities are in a race to produce decisions regarding such deals, Vestager said regulators “cannot be in a race.”

While Vestager shared that European regulators have the “highest bar” regarding such a matter, she underscored how regulators have their own legal framework to observe. With this, although the CMA seems firm about its view on the deal (as it even pushed the idea of favoring structural remedies over behavioral ones), Vestager said that every country’s system is different, which will result in diverse decisions about the case.

“The UK system is different. The US system is different,” said Vestager. “So even when we look at the same transaction with different markets and different legal provisions, sometimes we’ll get two different results.”

User forum

0 messages