Chile approves Microsoft's proposed Activision megadeal

3 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Chile’s competition authority, FNE, has now approved our acquisition by Microsoft, joining regulators elsewhere that have also recognized the deal’s benefits for competition and players.

As other responsible regulators review the facts, we expect more approvals like this one.

— Lulu Cheng Meservey (@lulumeservey) December 29, 2022

Microsoft achieved another success before the end of 2022 after receiving the approval of another competition watchdog for its proposed Activision merger. On Thursday, Chile’s Fiscalía Nacional Económica (FNE) announced its decision affirming the megadeal and explained its findings from its investigation in its covered market.

EVP Corporate Affairs and CCO of Activision Blizzard, Lulu Cheng Meservey, also confirmed the decision, noting that Chile now joins other countries that approved the merger, including Brazil, Saudi Arabia, and Serbia.

“Chile’s competition authority, FNE, has now approved our acquisition by Microsoft, joining regulators elsewhere that have also recognized the deal’s benefits for competition and players,” Meservey’s tweet reads. “As other responsible regulators review the facts, we expect more approvals like this one.”

Meanwhile, in its press release, FNE explained in detail the result of its probe, which tapped different issues also being scrutinized by other watchdogs. Mainly, it stressed that the merger wouldn’t substantially reduce competition due to the patterns and preferences of video game consumers in Chile.

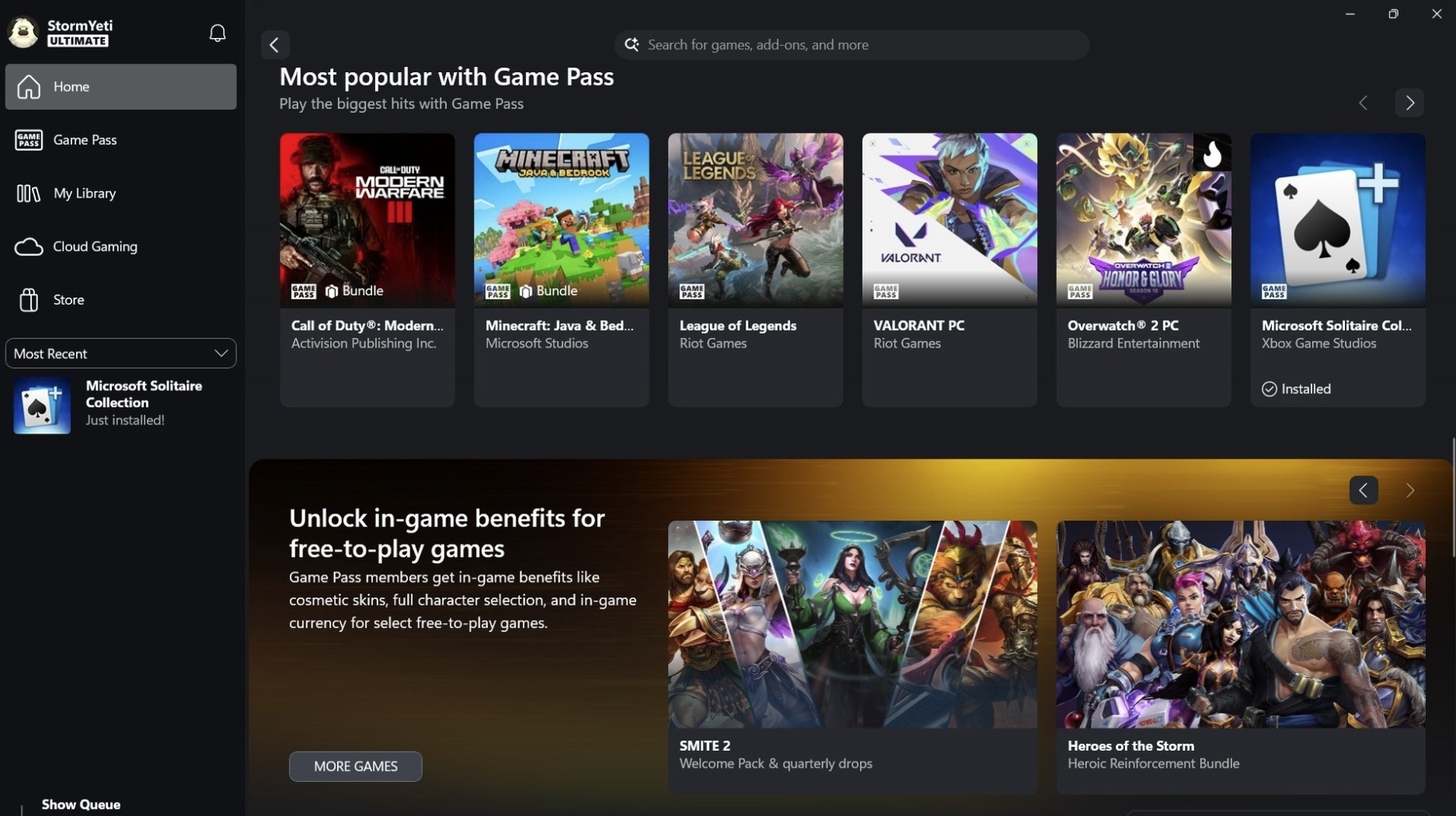

FNE directly addressed the issue regarding the possibility of Microsoft blocking its competitors from accessing Activision titles in the future. According to the Chile regulator, the concern was ruled out due to the competitive pressure Activision is facing now from its competitors. It also voiced the same view being repeatedly underlined by Microsoft that keeping Activision games away from its competitors doesn’t just make sense. FNE explained that PlayStation is generating significant income in favor of Activision, which weakens the argument about the blocking strategy. And in case the opposite happens, FNE stated that the influence of Call of Duty is not that huge in Latin America compared to other parts of the world. It added that through a survey it carried out, it determined that the blocking strategy would be ineffective in encouraging console switching among Chilean consumers. Also, FNE reasoned that Activision’s games are not the most relevant element for game consumers, dismissing the possibility of tipping in the marketing of next-generation consoles and subscription services.

Finally, to cement its decision favoring healthy competition, it pointed out the competitive pressure Sony and Nintendo have on Microsoft due to their huge video game market share. According to the watchdog, the merger will produce a relevant substitute for giant publishers, giving consumers more choices to explore.

Currently, the deal is still under deep investigation by other competition regulators around the globe, including the European Commission and the UK’s Competition and Markets Authority. FTC, meanwhile, is determined to block the deal, pushing it to file a complaint, which Microsoft trashed with solid responses. It is important to note, however, that this is not the only case Microsoft has to face to defend the deal. Weeks ago, a group of gamers filed a lawsuit, claiming the merger would give the company the vast power “to foreclose rivals, limit output, reduce consumer choice, raise prices, and further inhibit competition.” Prior to that, a Swedish National Pension System reserve funds holding Activision stock, Sjunde AP-Fonden or AP7, also filed a suit due to the “hastily negotiated” underpriced deal and alleged hidden agenda to protect Activision Blizzard CEO Bobby Kotick.

User forum

0 messages