Apple announces Pay Later BNPL feature; to handle financial responsibilities this time

3 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Apple will soon implement its buy now, pay later (BNPL) service called “Pay Later,” the company announced last Monday at WWDC. It is not the first time Apple is entering the finance world but what’s new about it is the arrangement the company has decided to take: it’ll be handling the financial tasks for the service, such as lending and credit checks.

Apple has a partnership with Goldman Sachs and other companies for its previous financial offers, including its Apple Card credit card. However, while Goldman Sachs still has a part in Apple’s new Pay Later service, it won’t be as big as the other tasks it used to handle. The firm will be issuing the Mastercard credit card for the Pay Later since, as Bloomberg stresses in a report, Apple doesn’t have a bank charter. Nonetheless, the general tasks of making decisions for the loans and checking credits will be handled by the Apple Financing LLC, which is licensed to provide lending services and is separate from Apple’s primary venture.

Apple will handle the assessment of applicants who will apply for the new feature built into Apple Pay. According to a CNBC report, Apple will only require soft credit checks. There are no details on how much the company would lend to applicants, but CNBC says it could be $1000 maximum. Once the loan is granted, the user will make the purchases through Apple Pay.

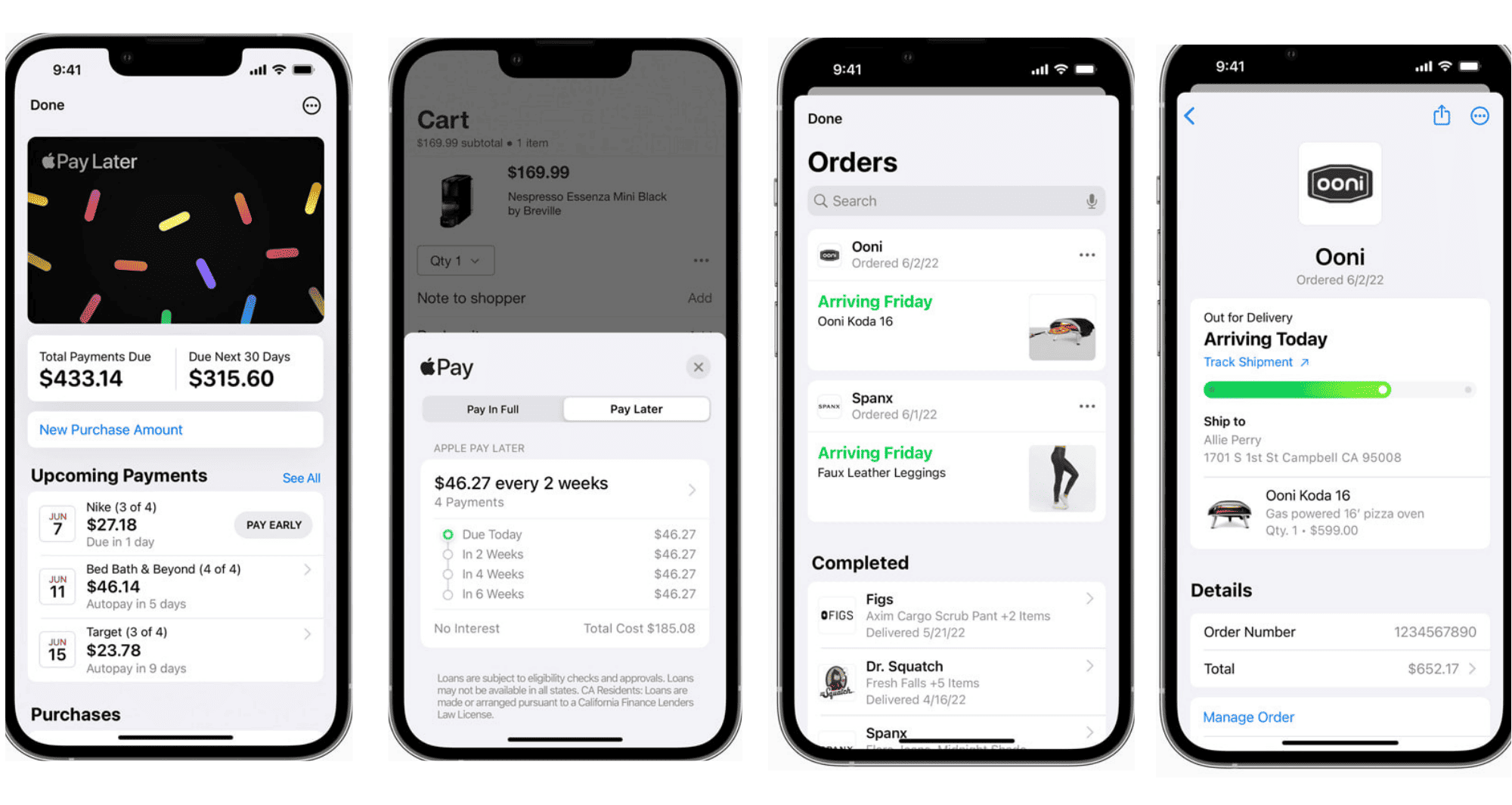

Users will make four equal installments via the Wallet app to pay back the loan with no interest within six weeks. The first payment will be upfront, while the rest will be made every two weeks (though you can choose to do it in advance). If the person misses a payment, Apple reportedly won’t report it to credit bureaus so it won’t negatively affect one’s overall credit score. Nonetheless, it is still not clear whether the company will charge a late fee or not.

While these initial details sound tempting, Apple’s new financial offer won’t come without any downsides of its own. Given its nature as a BNPL, Pay Later could mean possibilities of different financial challenges for the users, especially experiencing an overdraft.

Pay Later will be coming with iOS 16. The rollout will be first introduced to users in the US but will also be made available to other locations later. “Apple Pay Later is available everywhere Apple Pay is accepted online or in-app, using the Mastercard network,” notes Apple in a press release.

User forum

0 messages