After the 2019 PC boom comes the 2020 PC bust says analyst

4 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

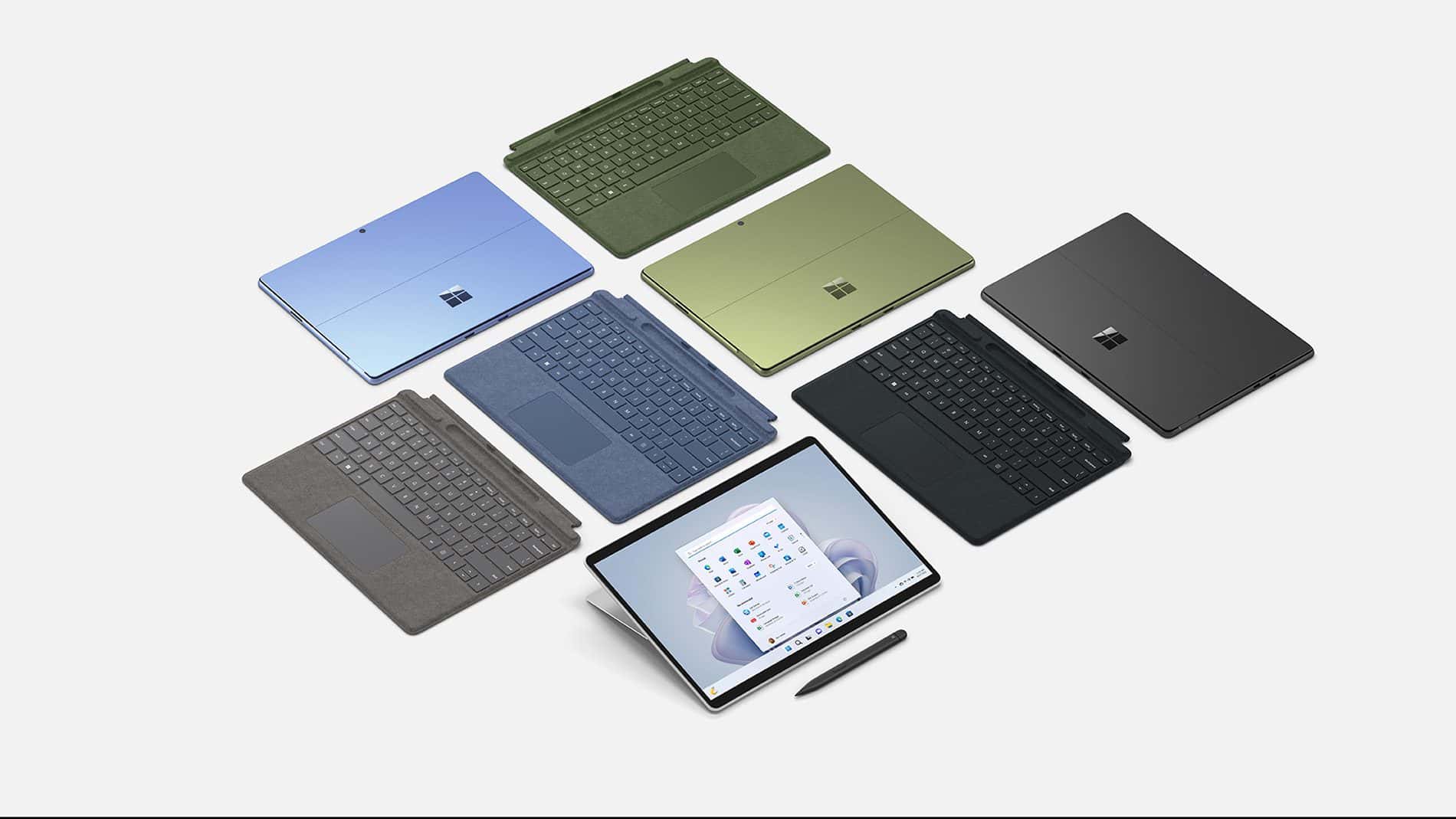

The global PC market has a great 2019, seeing robust growth for the first time in nearly a decade, largely due to the end of life of Windows 7.

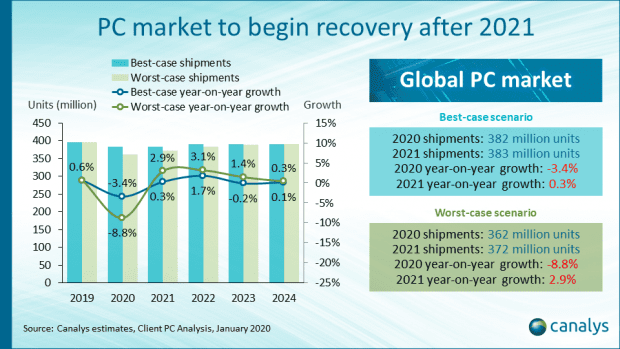

It was expected that 2020 would be somewhat quieter than this, but now Canalys reports that other factors have conspired to cause them to predict that the PC market will fall a massive 3.4% in 2020 even in their best-case scenario.

In the forecast released on 20 February 2020, Canalys compiled all the information available to it from multiple sources, including but not limited to equipment vendors, ODMs, OEMs, supply chain companies, channel partners, retailers and ISVs. The forecast for the first time includes analysis of the effects of the COVID-19 outbreak that has affected multiple countries around the world, albeit with a higher level of severity in China and Asia generally.

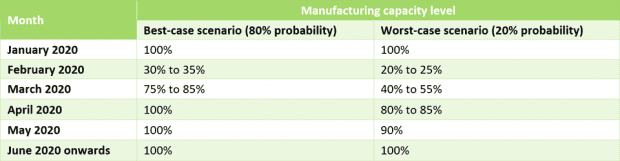

In the analysis Canalys presents two scenarios, for the best and worst cases, representing the minimum and maximum level of impact of the COVID-19 outbreak. The major difference between the two scenarios is in considering the length of time that it would take for normal operations to resume in China and the rest of the world with successful containment and control of the current COVID-19 outbreak.

Component manufactures based in Wuhan and some other provinces, such as Jiang Xu, are the most affected by the COVID-19 outbreak, as factory owners have been unable to resume full operations, partly due to a seriously short supply of workers, but also due to additional restrictions on working conditions imposed by the Chinese government making it difficult to operate as before. The impact on PC shipments is likely to be immediate, though PC assemblers, such as Foxconn, Quanta, Compal and Wistron, have reported a partial resumption of PC assembly in their Chinese factories.

Retailers have also been affected, and channel partners have received notifications from key PC vendors over the last two weeks that their PC shipments and replacement parts can be expected to arrive in up to 14 weeks – over three times the usual delivery time.

The United States, being the world’s number one market for PCs, is likely to be most affected by the shortage in the supply of client PCs. The effects will only be seen from late Q2 2020, given that most PC vendors have stockpiled inventory in 2019 in anticipation of another round of sanctions on Chinese imports by the US government. Seasonally, Q2 is a strong quarter for sell-in of Chromebooks and other notebooks as the US braces for back-to-school demand for PCs. Almost all vendors are likely to prioritize the US in the face of a shortage but maintaining a delicate balance of portfolios will be key.

Consumers outside of China will be affected only by supply shortages of PCs and spare parts, leading to higher prices for such equipment. Consequently, refresh rates are expected to lengthen slightly, leading to an overall fall in consumer demand.

In the best-case scenario, production levels are expected to revert to full capacity by April 2020, hence the biggest hit will be to sell-in shipments in the first two quarters, with the market recovering in Q3 and Q4. Thus, worldwide PC market shipments are expected to decline 3.4% year on year in 2020, with Q1 2020 down by 10% and Q2 2020 by 9%. PC market supply will normalize by Q3 2020.

In the worst-case scenario, production levels are not expected to revert to normal until as late as June 2020. As a result, sell-in shipments in the first three quarters will show a significant year-on-year decline compared with 2019. The market is then expected to recover in Q4 2020. Thus, worldwide PC market shipments are expected to decline year on year for three consecutive quarters, with a 21% decline in Q1, a 23% decline in Q2 and a 6% decline in Q3. This will be followed by 13% growth in Q4 as the market stabilizes.

Therefore, the worldwide PC market will suffer a heavy decline of 9% year on year in 2020 when compared with 2019, driven by poor performance in the first three quarters in all the major regions, with market recovery being delayed until Q4.

Thankfully Canalys expects, with 80% certainty, that the best-case scenario will prevail.

User forum

0 messages