Microsoft seen as a safe harbour while Apple, Google's consumer focus punished

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

While we and our readers often complain about Microsoft’s focus on enterprise productivity, investors are once again rewarding the company’s direction while punishing the consumer focus of their competitors.

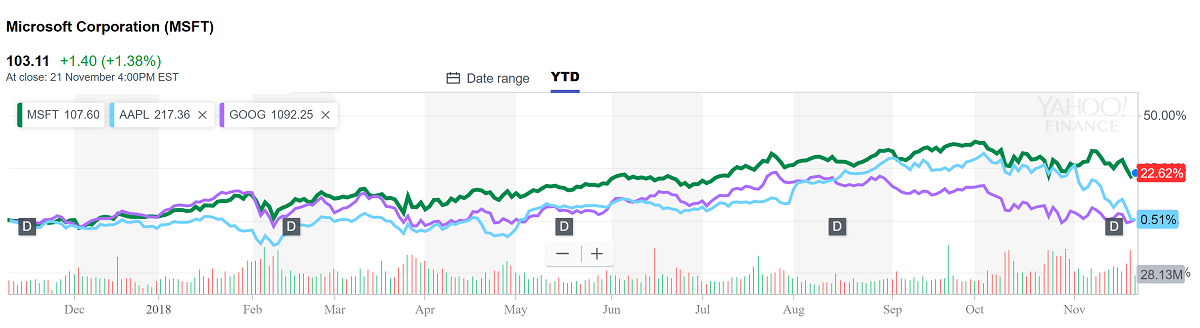

As can be seen in the graph above, year to date Microsoft is still up 22%, while Apple and Google have given back all their gains so far.

“Microsoft is being viewed by many investors as a place to park your assets while we go through this white-knuckle period,” Wedbush analyst Daniel Ives said. “The high-flier consumer names are getting taken to the woodshed.”

Investors are concerned about slowing revenue growth at the so-called FANG companies (Facebook, Apple, Netflix and Google), a club of high flyers Microsoft has traditionally been excluded from.

Now investors are betting company spending on cloud services and software will remain strong as companies strive to increase efficiency and productivity, while Facebook and Google are increasingly coming under scrutiny for their consumer data practices.

Microsoft’s cloud segment, in particular, is expected to do well, with Office 365 the lead programs in the market for cloud-based productivity tools, while Azure services for storing data and running apps in the cloud is in a solid second position to Amazon’s AWS. Microsoft is also increasingly relying on a steady subscription business which is less subject to volatility.

Spending on enterprise software is expected rise 8.3 percent in 2019, the fastest growing segment within information technology, according to projections from Gartner Inc.

Are Satya Nadella’s oft-criticised moves smarter than we give him credit for? Let us know below.

Via Bloomberg.com