IDC: PC sales up 55.2% in Q1 2021 but will the good times continue?

3 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

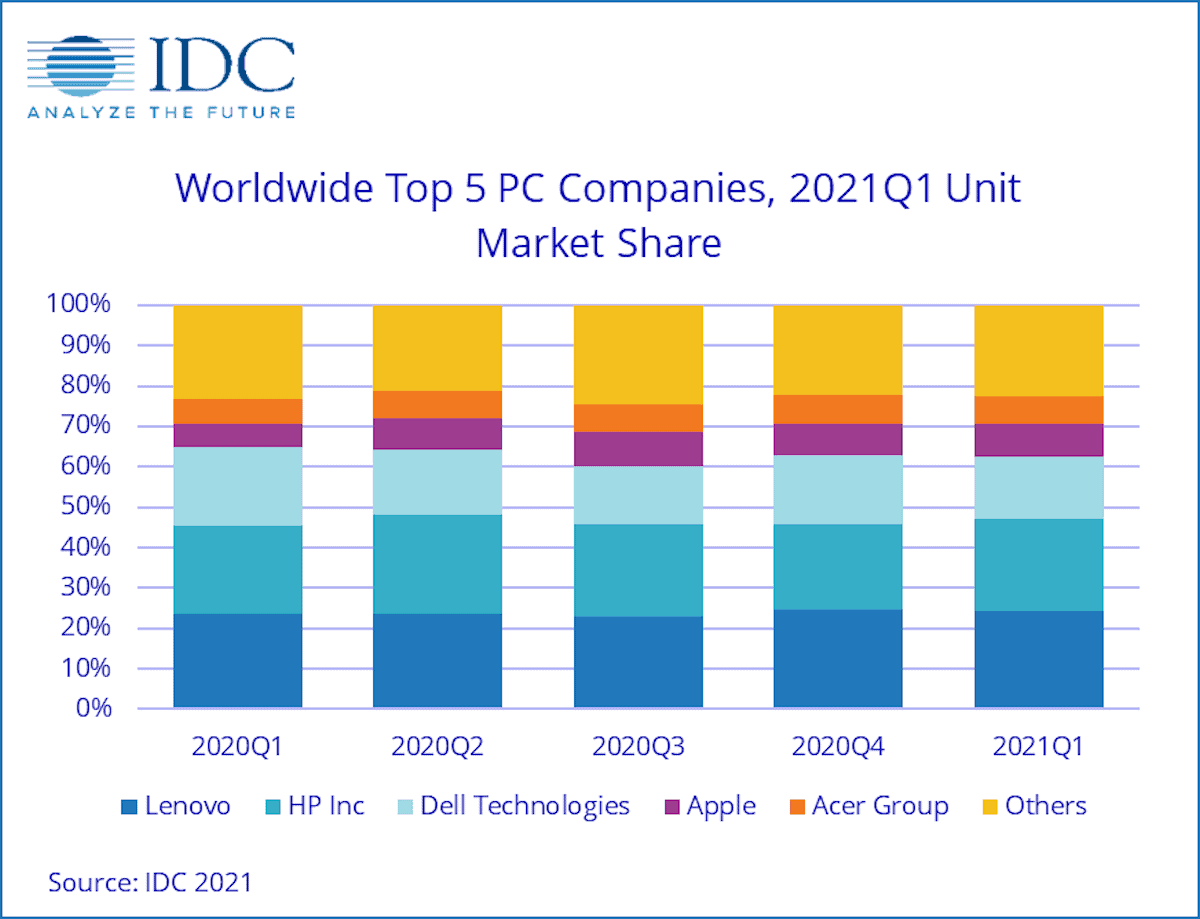

It has been nearly a decade since PC vendors have had it so good. The IDC reports that surging demand for PCs in 2020 have continued into 2021, with global shipments of traditional PCs, including desktops, notebooks, and workstations up 55.2% year over year during the first quarter of 2021.

A total of 84 million PCs were sold worldwide in 1Q21, and while this was down 8% from Q4 2020, this was the smallest post-holiday-season drop since 2012, when sales declined by 7.5%.

“Unfulfilled demand from the past year has carried forward into the first quarter and additional demand brought on by the pandemic has also continued to drive volume,” said Jitesh Ubrani research manager for IDC’s Mobile Device Trackers. “However, the market continues to struggle with setbacks including component shortages and logistics issues, each of which has contributed to an increase in average selling prices.”

The last bit would read as further good news for vendors. Average selling price growth has been boosted not only by shortages but primarily by growth in gaming, the need for higher performance notebooks in the enterprise, and an increase in demand for touchscreens within the education segment.

| Top 5 Companies, Worldwide Traditional PC Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (Preliminary results, shipments are in thousands of units) | |||||

| Company | 1Q21 Shipments | 1Q21 Market Share | 1Q20 Shipments | 1Q20 Market Share | 1Q21/1Q20 Growth |

| 1. Lenovo | 20,401 | 24.3% | 12,826 | 23.7% | 59.1% |

| 2. HP Inc. | 19,237 | 22.9% | 11,722 | 21.7% | 64.1% |

| 3. Dell Technologies | 12,946 | 15.4% | 10,495 | 19.4% | 23.4% |

| 4. Apple | 6,692 | 8.0% | 3,164 | 5.8% | 111.5% |

| 5. Acer Group | 5,837 | 7.0% | 3,364 | 6.2% | 73.5% |

| Others | 18,868 | 22.5% | 12,552 | 23.2% | 50.3% |

| Total | 83,981 | 100.0% | 54,123 | 100.0% | 55.2% |

| Source: IDC Quarterly Personal Computing Device Tracker, April 9, 2021 | |||||

The big question is whether the good times will continue once the pandemic is over. IDC think for PC vendors there is a good chance this will be the case, at least for 2 -3 years.

“There is no question when entering 2021 the backlog for PCs was extensive across business, consumer, and education,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “The ongoing shortages in the semiconductor space only further prolong the ability for vendors to refill inventory and fulfill orders to customers. We believe a fundamental shift has occurred around the PC, which will result in a more positive outlook for years to follow. All three segments – business, education, and consumer – are experiencing demand that we didn’t expect to happen regardless of many countries beginning their ‘opening up’ process. Component shortages will likely be a topic of conversation for the majority of 2021, but the more important question should be what PC demand will look like in 2-3 years.”

International Data Corporation’s full (IDC) Worldwide Quarterly Personal Computing Device Tracker can be purchased here.

User forum

0 messages