Microsoft Q1 FY17 Earnings: Azure revenue grew 116%, commercial cloud gross margin was 49%

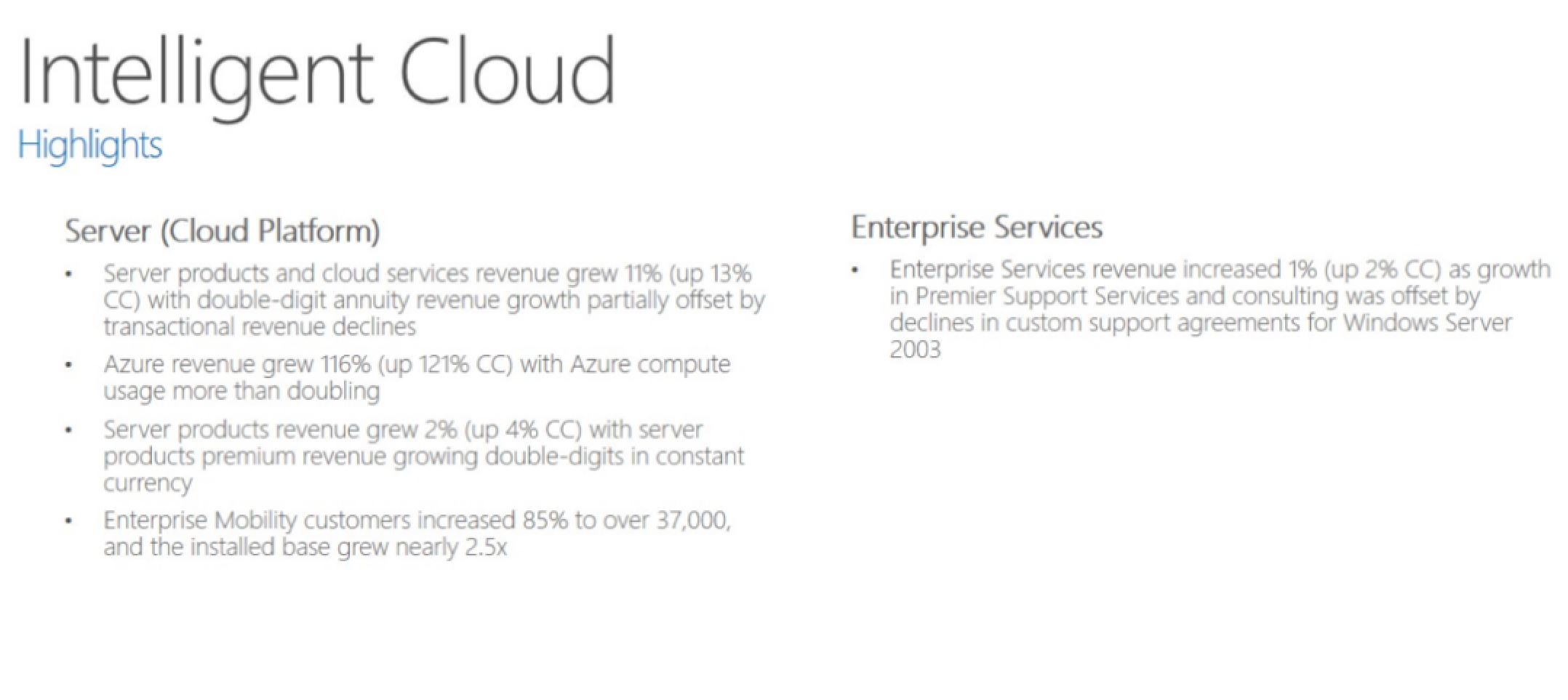

Microsoft today announced their FYQ1 2017 earnings results. Revenue was $20.5 billion GAAP, and $22.3 billion non-GAAP and operating income was $5.2 billion GAAP, and $6.0 billion non-GAAP. Revenue in Intelligent Cloud grew 8% (up 10% in constant currency) to $6.4 billion, with the following business highlights:

- Server products and cloud services revenue increased 11% (up 13% in constant currency) driven by double-digit annuity revenue growth

- Azure revenue grew 116% (up 121% in constant currency) with Azure compute usage more than doubling year-over-year

- Enterprise Services revenue increased 1% (up 2% in constant currency) with growth in Premier Support Services and consulting offset by declines in custom support agreements

For the first time ever, Microsoft revealed the Commercial Cloud gross margin percentage.

Microsoft noted that their cloud offering is actually very differentiated, noting they operate in more regions than any other provider, offer “hyperscale”, had more certifications than any other provider, which allowed them to offer cloud services to many governments, including Germany under strict German data privacy laws and also China (the only one allowed) and offered unique features such as a hybrid stack and also higher level services and applications which other companies like Amazon and Google could just not provide.

Microsoft said they would continue to invest in the business and noted that when companies purchased one cloud service they often then purchased another, and even when they start with just commodity storage it is still a gateway to more sophisticated and higher margin services.

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

User forum

0 messages