IDC see detachable tablet market growing powered by Apple and Microsoft

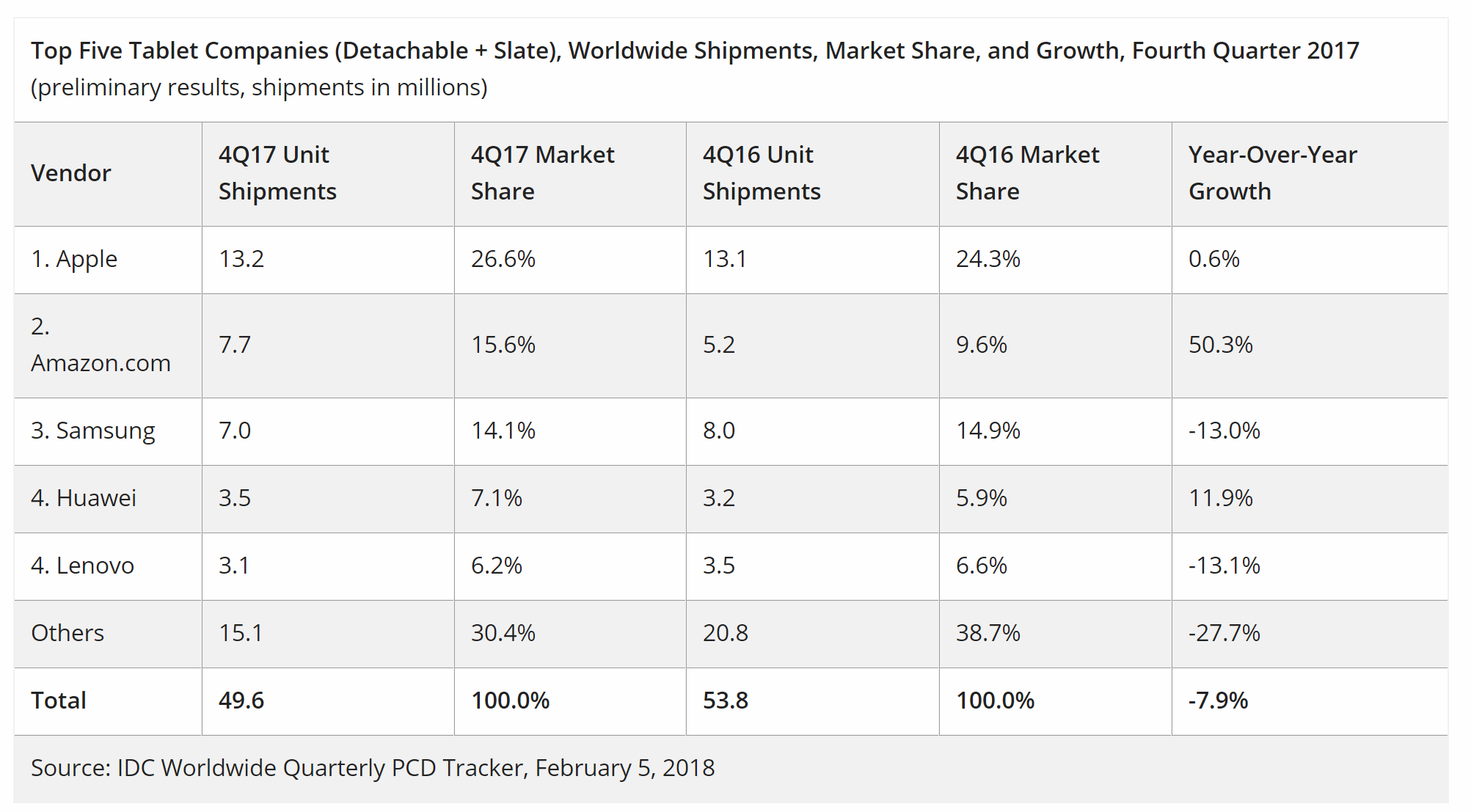

The IDC has posted their estimates for tablet shipments in Q4 2017, and on this occasion has focused strongly on the detachable tablet (e.g. iPad Pro, Surface Pro) vs slate market (regular iPad, most Android tablets).

The former category is growing, having grown 10.3% YoY, while traditional slate tablets (the larger part of the market) slid 7.6%.

6.5 million detachables were shipped in Q4 2017, while 43.1 million slate tablets were shipped.

“To date, much of the trajectory of the detachable market has been attributed to Microsoft and Apple pushing their wares in the U.S.,” said Jitesh Ubrani, senior research analyst with IDC’s Worldwide Quarterly Mobile Device Trackers. “However, continued success of this category hinges on the willingness of other PC vendors to participate and more importantly, consumers from other countries to adopt the new form factor over convertible PCs.”

The IDC expected the detachable category to grown even faster once Windows on ARM close the battery life gap between iOS and Windows tablets.

“After a concerning downturn in the last quarter of 2016 and first half of 2017, we are elated to see the detachable market maintain another quarter of growth,” said Lauren Guenveur, senior research analyst for IDC’s Devices and Displays team. “With the first wave of Windows on ARM products expected to begin shipping in the second quarter of 2018, we believe the detachables category has the potential to continue its growth trajectory. Many of these products are being introduced at the premium end of the market. What remains glaringly sparse, and needed, are strong players in the mid-segment of the market.”

The IDC notes traditional slates do not offer much in terms of productivity and have been largely relegated to simple media consumption devices with end-user demand having slowed significantly in the last few years, with 2017 declining 7.6% from the previous year. Due to low margins vendors were instead eager to pursue the productivity market with detachable devices instead.

The IDC notes that while the lower-priced iPad has continued to drive a strong consumer upgrade cycle, the shifting focus was to iPad Pro and its potential in the commercial and education segments. With the only expected tablet growth to come from these segments, Apple’s recent launch of “Apple at Work” showed their commitment to maintaining its leader position.

Amazon.com was able to steal the second position from rival Samsung as the online giant offered steep discounts during the holiday season. The low-cost tablets have been quite effective as shopping catalogs for Amazon’s online storefront and in recent quarters the company has taken things a step further by including its voice assistant, Alexa, in the latest tablets and by expanding to new markets around the world.

Samsung dropped to the third position behind Amazon. Shipments of its detachable portfolio continue to rise, however these gains are outweighed by the declines seen among its slate models. As its lower-cost Tab A and E series is challenged by vendors promising better value, Samsung will face a particular challenge in upgrading its base to both a higher-priced and detachable device.

Huawei’s half-hearted approach to the growing detachable segment does not offer a promising outlook for the company. However, the company’s strong brand, aggressive channel strategy, and inclusion of cellular connectivity in its slate tablets has helped cement its rank in the top 5.

Lenovo’s ability to leverage its strength from the traditional PC business is starting to pay off as the company’s detachable tablet business has grown in the past year. However, the bulk of Lenovo’s tablets are still comprised of slates that offer great value at low prices.

See the full numbers below.

Read more at the IDC here.

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

User forum

0 messages