Xiaomi about to overtake Apple as 3rd largest smartphone company

2 min. read

Published on

Read our disclosure page to find out how can you help MSPoweruser sustain the editorial team Read more

Apple’s share price was up sharply yesterday on middling revenue growth of 1%, but it is certainly not due to the performance of their smartphone division.

Worldwide smartphone shipments declined 2.3% year over year in the second quarter of 2019.

Going by the IDC’s numbers, Apple may have single-handedly been responsible for the smartphone market tanking, with the quarterly numbers down 8 million units, suspiciously similar to Apple’s drop in sales between Q2 2018 and Q2 2019.

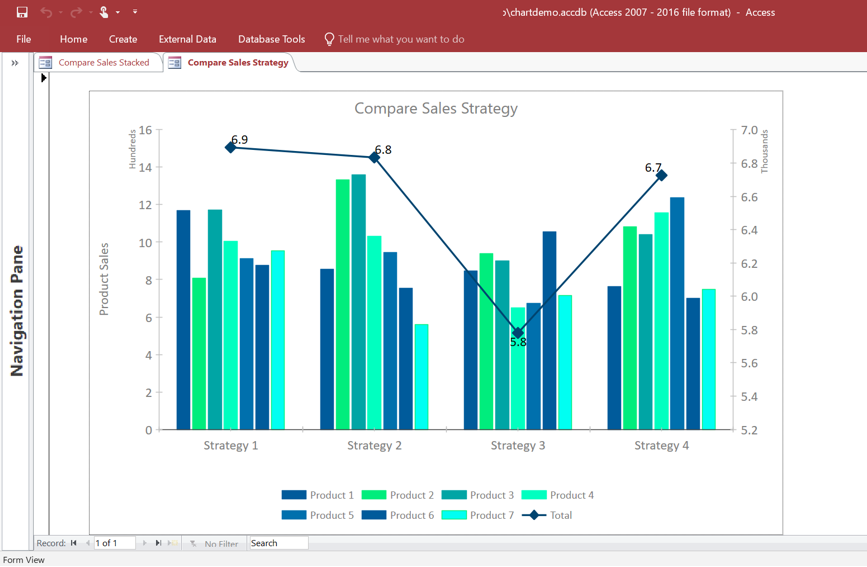

| Company | 2Q19 Shipments | 2Q19 Market Share | 2Q18 Shipments | 2Q18 Market Share | Year-Over-year Change |

| 1. Samsung | 75.5 | 22.7% | 71.5 | 21.0% | 5.5% |

| 2. Huawei | 58.7 | 17.6% | 54.2 | 15.9% | 8.3% |

| 3. Apple | 33.8 | 10.1% | 41.3 | 12.1% | -18.2% |

| 4. Xiaomi | 32.3 | 9.7% | 32.4 | 9.5% | -0.2% |

| 5. OPPO | 29.5 | 8.9% | 29.4 | 8.6% | 0.3% |

| Others | 103.4 | 31.0% | 112.4 | 32.9% | -8.0% |

| Total | 333.2 | 100.0% | 341.2 | 100% | -2.3% |

Apple shipped 33.8 million new iPhones during 2Q19, which was down significantly from the same quarter one year ago. Regardless of the slightly lower market share and device selling prices, the iPhone installed base continued to grow.

The numbers show that now 3rd placed Apple may soon drop into 4th, with Xiaomi only 1.5 million handsets behind Apple.

Chinese company Xiaomi, who also makes shoes and hair trimmers, experienced small year-over-year decline during the quarter, shipping a total of 32.3 million smartphones. The challenges faced in returning to positive year-over-year growth in China are partly attributed to increased competition from Huawei. The company is also a great success in India, due to its focus on both offline and online channels. It aims to have 10,000 retail stores by the end of 2019, as well as expanding its offline network.

Samsung maintained the top position in the market for 2Q19, and returned to annual growth of 5.5% with a total of 75.5 million smartphones shipped. The company struggled to sell their flagship devices, which they attribute to a weak market; but the cheaper A-series devices sold very well.

Huawei’s shipment volumes declined 0.6% compared to 1Q19, which is impressive given U.S.-China trade tensions. Shipment volumes in China hit an all-time high and accounted for 62% of Huawei’s 2Q19 total with 36.4 million units. The P30 and P30 Pro were a resounding success. Actions taken following the U.S trade ban certainly contributed towards this success during the quarter.

OPPO performed well in China and India, and accounted for nearly three-quarters of its shipments in 2019. In China, OPPO launched its Reno series in the quarter; who’s sales performance was impacted by Huawei’s P series. The low-end model, the A9, and the online-exclusive K3 model helped support its overall performance.

IDC’s full report can be seen here.

User forum

0 messages